The current state of the Oakland FL housing market presents a balanced scenario, with elements favorable to both buyers and sellers. While buyers can benefit from homes selling slightly below list price and a diverse inventory, sellers also have the advantage of a relatively quick sales process and the possibility of receiving multiple offers. However, as with any market, the balance between buyer and seller advantages can shift over time.

Table of Contents

Oakland Housing Market Trends in 2024

According to Redfin's data, in February 2024, the median home price in Oakland experienced a significant decline of 24.7% compared to the previous year, settling at $581,000. Despite this decline, the market remains active, with 16 homes sold in February, representing a notable increase from the 10 homes sold during the same period last year.

How is the Oakland Housing Market Doing Currently?

The current state of the Oakland housing market reflects a trend of price depreciation but heightened activity in terms of transactions. The median home price decrease of 24.7% may seem alarming at first glance, but it's essential to analyze this data within the broader context of market dynamics.

On average, homes in Oakland are spending 56 days on the market, which is a slight improvement from the previous year's average of 65 days. This indicates a faster turnover rate, suggesting a continued interest in the local housing inventory.

How Competitive is the Oakland Market?

Describing the Oakland housing market as competitive would be an accurate assessment. With homes selling in an average of 45 days, there's a sense of urgency among both buyers and sellers. Some properties even receive multiple offers, further fueling the competitive nature of the market.

Additionally, the data reveals that homes in Oakland typically sell for 2% below their list price, with a sale-to-list price ratio of 99.1%. This slight discount, coupled with the relatively quick turnaround time, highlights the negotiation dynamics at play in the local real estate scene.

Are There Enough Homes for Sale to Meet Buyer Demand?

While Oakland presents an attractive market for buyers, there's a question of inventory adequacy. The average home sells for about 2% below the list price, indicating a certain level of bargaining power for buyers. However, the time on market metric suggests that demand is strong, with homes going pending in approximately 45 days.

Furthermore, hot homes – those highly sought after – can sell for around list price and go pending in just 10 days. This highlights the existence of segments within the market that experience heightened competition, potentially leading to faster sales and higher sale prices.

What is the Future Market Outlook for Oakland?

The future outlook for the Oakland housing market is subject to various factors, including economic conditions, interest rates, and demographic shifts. While the current data presents a nuanced snapshot of the market, predicting future trends requires a deeper analysis of these underlying factors.

It's worth noting that in the first quarter of 2024, 34% of Oakland homebuyers expressed interest in moving out of the area, while 66% looked to stay within the metropolitan region. This trend suggests a certain level of local loyalty but also underscores the importance of understanding migration patterns in shaping future market dynamics.

Oakland Housing Market Forecast for 2024 and 2025

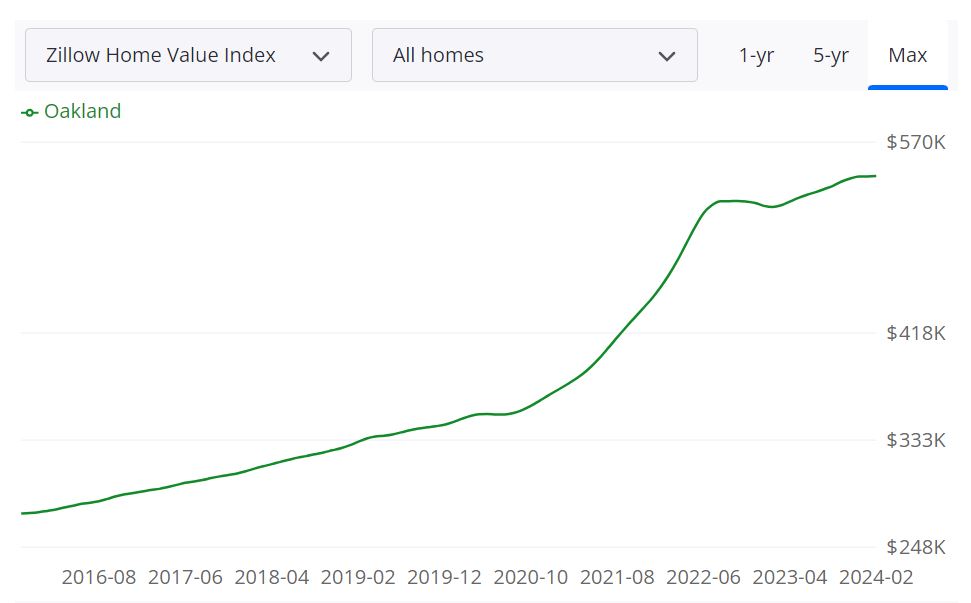

According to Zillow, the average home value in Oakland stands at $543,244, marking a 4.7% increase over the past year, reflecting the ongoing changes in the real estate landscape.

Understanding Key Housing Metrics

1. For Sale Inventory: As of February 29, 2024, the for-sale inventory in Oakland plays a crucial role in shaping market dynamics. This metric provides insights into the available housing stock and influences buyer-seller dynamics.

2. New Listings: With 8 new listings recorded on February 29, 2024, the influx of new properties into the market indicates the level of activity and interest among sellers, potentially impacting supply and demand dynamics.

3. Median List Price: The median list price, standing at $583,633 as of February 29, 2024, serves as a benchmark for both buyers and sellers, guiding pricing strategies and negotiations in the market.

Each of these metrics offers valuable insights into the Oakland housing market, enabling stakeholders to make informed decisions regarding buying, selling, or investing in properties.

While analyzing these metrics, it's essential to consider various factors influencing the market, such as economic conditions, demographic trends, and government policies. Additionally, fluctuations in interest rates and consumer confidence levels can also significantly impact housing dynamics.

Forecast and Projections

For buyers, understanding these housing metrics can help in gauging market conditions and identifying potential opportunities for investment. With the average home value on the rise, buyers may need to act swiftly to secure desirable properties.

On the other hand, sellers can leverage these insights to determine optimal listing prices and marketing strategies. With a steady flow of new listings and a favorable median list price, sellers may find opportunities to capitalize on the current market trends.

Looking ahead, the Oakland housing market is expected to continue experiencing fluctuations, influenced by both local and global factors. While projections indicate potential growth in home values, market conditions may vary, necessitating cautious analysis and strategic decision-making.

Are Home Prices Dropping in Oakland?

Despite fluctuations in the Oakland housing market, there is currently no indication of significant or widespread drops in home prices. While market conditions may vary by neighborhood and property type, overall, prices have shown resilience, driven by factors such as demand-supply dynamics, economic conditions, and consumer sentiment.

Will the Oakland Housing Market Crash?

The possibility of a housing market crash is a concern for both buyers and sellers. However, experts suggest that while fluctuations and corrections may occur, a full-scale crash is unlikely in the foreseeable future. Factors such as strong demand, limited inventory, and stable economic conditions contribute to the market's resilience.

Moreover, regulatory measures and lessons learned from past downturns have helped mitigate risks and maintain stability in the housing market. Nevertheless, it's essential for stakeholders to remain vigilant and monitor market trends closely.

Is Now a Good Time to Buy a House in Oakland?

Deciding whether it's the right time to buy a house in Oakland depends on various factors, including individual circumstances, financial readiness, and long-term goals. Despite fluctuations, the current market presents opportunities for both buyers and sellers.

For buyers, favorable interest rates and a diverse selection of properties may make it an attractive time to enter the market. However, they should be prepared to act quickly and make competitive offers in the face of stiff competition.

Meanwhile, sellers can capitalize on rising home values and strong demand by strategically pricing their properties and leveraging effective marketing strategies.

Investing in the Oakland Real Estate Market

1. Population Growth and Trends

Oakland's population dynamics play a crucial role in shaping its real estate market. Understanding the trends in population growth is essential for investors looking to capitalize on the city's potential.

- Steady Growth: Oakland has experienced steady population growth, contributing to the demand for housing. A growing population often correlates with increased housing needs, presenting opportunities for real estate investors.

- Metro Attraction: The city's attractiveness to individuals from other metros, as indicated by migration trends, adds to its overall population growth. This influx can drive demand for both rental and owned properties.

2. Economy and Jobs

The economic landscape of Oakland is a significant factor influencing the real estate market. Investors should consider the city's economic health and job market stability when evaluating potential opportunities.

- Economic Diversity: Oakland boasts a diverse economy, including sectors like technology, healthcare, and manufacturing. A diverse economy can contribute to job stability and sustained demand for housing.

- Job Market: The presence of job opportunities and a thriving job market can attract individuals, fostering a healthy demand for rental properties. Investors should monitor key industries to gauge the city's economic resilience.

3. Livability and Other Factors

Livability factors contribute significantly to the appeal of a city, impacting real estate investment decisions. Analyzing the quality of life in Oakland provides insights into its long-term real estate prospects.

- Cultural Vibrancy: Oakland's cultural richness and diverse community make it an attractive place to live. A vibrant cultural scene often correlates with sustained demand for housing, benefiting real estate investors.

- Infrastructure and Amenities: Consideration of infrastructure development and the availability of amenities can impact property values. Proximity to schools, parks, and public services enhances the overall livability of a neighborhood, making it more appealing for potential tenants or buyers.

4. Rental Property Market Size and Growth

For investors specifically interested in the rental market, understanding the size and growth of Oakland's rental property market is crucial for making informed decisions.

- Market Size: Oakland's rental market is substantial, driven by factors like population growth and job opportunities. Investors can tap into this market by providing rental properties that cater to diverse tenant needs.

- Growth Potential: Monitoring trends in rental property demand and pricing can unveil opportunities for investors. Factors such as the city's population growth, job market dynamics, and changing preferences contribute to the growth potential of the rental market.

5. Other Factors Related to Real Estate Investing

Several additional factors play a role in shaping the real estate investment landscape in Oakland. Investors should consider these aspects for a holistic understanding of the market.

- Regulatory Environment: Stay informed about local regulations and zoning laws that may impact property development and investment strategies.

- Interest Rates: Fluctuations in interest rates can influence the cost of financing, affecting the feasibility of real estate investments.

- Community Development Plans: Explore city initiatives and development plans, as they can provide insights into future growth areas and potential investment hotspots.

References:

- https://www.realtor.com/realestateandhomes-search/Oakland_FL/overview

- https://www.redfin.com/city/13001/FL/Oakland/housing-market

- https://www.zillow.com/home-values/26252/oakland-fl/