There are many reasons to invest in Atlanta investment properties in 2020 such as positive forecast, lucrative returns, growing population, great neighborhoods & school systems, good infrastructure, solid appreciation of properties, etc. Metro Atlanta is fast becoming a shinning star in the real estate investment sector.

Here are some conspicuous signs for investors to go ahead and plan out their investment in the growing Atlanta Real Estate Market in 2020.

Why You Should Buy Atlanta Investment Properties? |

|

|

|

The Atlanta Housing Market has seen a constant growth in both the suburbs as well as the metro area over the past decade. Atlanta metro area is home to over 5.5 million, making this area a great place to buy investment properties.

Atlanta has a growing economy that is 8th in the nation for GDP and is home to a wide variety of business that includes Fortune 500 companies. Relocation of payment processing giant NCR is expected to bring more than 3,500 jobs to the metro Atlanta region.

Atlanta is projected to be the 6th most populated metro areas with 7.3 Million population by 2020 (US Census Bureau). Atlanta offers access to 3 major interstate freeways connecting major regions of the US (South east, North east, Midwest, West).

Atlanta is not only home to the world's most traveled airport, Site Selection Magazine named Georgia the best state to do business for the fifth year in a row. Metro Atlanta ranks as the nation’s 6th largest information sector.

Not to mention, social media giant Facebook is planning to build a sprawling new data center in the Walton County town about 40 miles east of Atlanta.

Atlanta has some of the best schools in the country such as Morningside Elementary School, Heards Ferry Elementary School, Charles R. Drew Charter School, Inman Middle School, Chamblee Charter High School and Early College High School At Carver.

These are just a few to name. Overall, there are 100 schools in Atlanta. Having all these good schools is a good thing for renters in Atlanta.

Table of Contents

Atlanta Real Estate Market Statistics

Let us look at some of the real estate data from the past few years. According to the Atlanta Journal Constitution, rent prices rose in 2015 by a margin of 8.1 percent compared to the previous year. In 2016, the rent rose by 6,5 per cent.

Steady growth within the market has been bolstered by continued job growth coupled with a strong local economy. By August 2016, the rent prices had grown for eight consecutive months. The city averted a late 2015 rental decrease that affected a majority of markets, mostly attributed to Atlanta's robust job market.

A big number of companies including Interface and NCR shifted their operations to Atlanta, GA bringing with them loads of job opportunities. In July 2016, the average rent reached a high of $1,100 with an occupancy level of 94.5%.

The current median rent in Atlanta is $1,742, which is higher than the Atlanta-Sandy Springs-Roswell Metro median of $1,500. An upward trend of the average rent appreciating is evident. Considering current trends, the rent will continue increasing in 2020 and anyone would gain if they invest in the current market handsomely.

Atlanta was ranked at #11 in the U.S. Markets to Watch by PWC.com. Cities like Atlanta & Dallas are benefiting from fundamental demographic and economic shifts. It is one of emerging markets in South's Atlantic region.

Being the third largest metropolitan in the southeast, Atlanta attracts families from all over the Midwest as well as the southern united states. In the year 2017, 74,500 new jobs were created only in the Atlanta region.

The figure represents an annual growth rate of 2.85% which is relatively greater compared to the current national average which stands at 2.35%.

The job growth impacted the population by growing it at a 4% rate, which is definitely a promising sign for any property investor looking to buy property in Atlanta.

The income per capita in Atlanta is $38,686, which is 45% higher than than the Georgia average and 30% higher than than the national average. The median household income is $49,398, which is 3% lower than than the Georgia average and 11% lower than than the national average.

The unemployment rate in Atlanta is 7%, which is 45% higher than than the national average. The poverty rate in Atlanta is 24% which is 59% higher than than the national average.

The Georgia economy, which had a weaker-than-average first half to the year, seemed to hit the gas in August 2019, adding 20,800 jobs, as reported by the state’s labor department. With the growth in the labor pool, the unemployment rate remained steady at 3.6%.

So far this year, Georgia has added 50,800 jobs in sectors such as professional and business services, hospitality, government, information, financial services and technology.

According to Software.org, Georgia ranks 9th for software jobs. A total of about 105,453 software jobs have been added in Georgia so far in 2019, which is 3.4% of the nation’s total. The tech sector in Georgia has grown at a pace of more than 4% a year – more than twice as fast as the state’s overall job growth.

Atlanta Investment Property Forecast 2020

What are the Atlanta real estate market predictions for 2020? According to Zillow.com, the Atlanta housing market is currently a buyer’s market.

The median home value in Atlanta is $264,500. Atlanta home values have risen by 4.8% over the past year and their Atlanta real estate market forecast is that the prices will continue to rise by 6.6% within the next year.

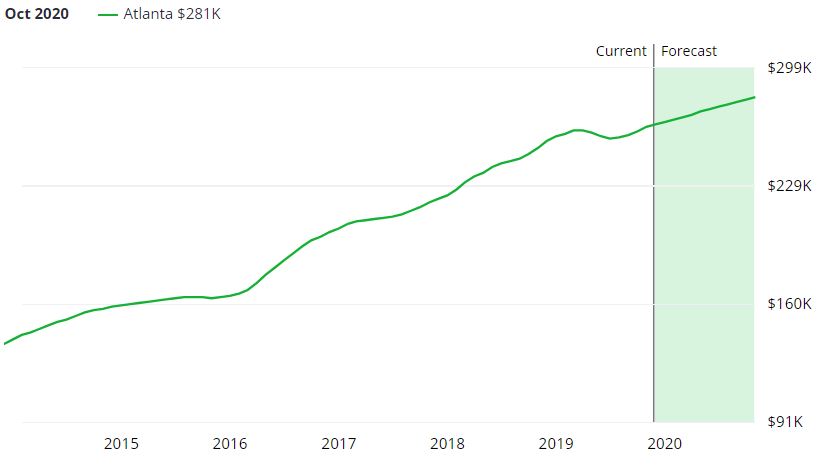

Here is the Atlanta real estate price appreciation graph by Zillow. It shows us the current home price appreciation forecast of 6.6% till Oct 2020.

The median list price per square foot in Atlanta is $234, which is higher than the Atlanta-Sandy Springs-Roswell Metro average of $132. The median price of homes currently for sale in Atlanta is $320,000 while the median price of homes that have been sold is $241,800.

Zillow reports that 22.7% of the listings in Atlanta had a price cut in Oct 2019, which is a good thing for buyers. It shows sellers were willing to negotiate on prices as they were finding it more and more difficult to sell homes at asking prices.

The median rent price in Atlanta is $1,742, which is higher than the Atlanta-Sandy Springs-Roswell Metro median of $1,500.

According to a report published in Hotpads.com, Atlanta’s rents have been quickly on the rise since 2018, outpacing San Francisco. Intown rent prices continue rising, even though the city boasts almost twice as many new rental offerings as last year.

The city’s rental housing stock has spiked overall by about 71 percent. In Midtown, it’s increased year-over-year by nearly 173 percent, per the report.

The good news is Atlanta renters have many new rental listings to choose from — the city saw 71 percent more newly-available rental listings come online over the past year. Renters in Midtown and North Buckhead really hit the jackpot, with each neighborhood reporting newly-available rental inventory increases over 150 percent year-over-year.

- Per capita income: $40,595

- Population density: 3,617 per square mile

- Median household income: $51,701

- Percent renters: 54%

- Median rent: $1,714%

According to Forbes, Atlanta is among the markets with strong demand for real estate. It is a hot-spot of real estate demand, with prices up 4% to 5% in the past year. The home prices are soaring in Atlanta and so is the job growth.

Why You Should Buy Atlanta Investment Properties?

Atlanta, GA is an investor's goldmine. After experiencing years of slow growth, Atlanta, GA has come up to join some of the most prospective real estate investment hubs in the USA. By doing some research on the Atlanta real estate market, we have found 21 reasons to buy Atlanta investment properties in 2020.

- Among the best investments in Atlanta, are mortgages. The fact that home prices are relatively below income levels, is an indication that they still got a space to flex and improve, leading to equity cushions.

- Currently, construction loans have a lower risk level courtesy of the expanding demand. Fulton county, Gwinnett and DeKalb are some of the regions with a prospected construction increase with a projection of more than 10,000 units in each.

- Solid appreciation values are just some of the many reasons to buy Atlanta investment properties in 2020. With an average 500 people moving to Atlanta everyday, the returns will keep on appreciating and given that real estates are assets, profits continue for a lifetime.

- Supply and Demand are the main pillars of real estate growth, If there's a high demand of units, the expected returns are also expected to be high. With the previously discussed numbers, demand of units in Atlanta is only going to increase. Investing in anticipation gives the investor an upper hand especially where the numbers have been confirmed.

- Buying investment properties in Atlanta that will grow or hold their value is just but the goal of any investor. Property should grow in value in a way to ensure that the investors money is secure, while also bringing in income of service. The promising state of the Atlanta Real Estate Market makes it safe for any investor to put their money and expect modest returns.

- Local Infrastructure in Atlanta is also a major boost for any prospective investor and one fo the best reasons to buy Atlanta investment properties. With an international airport, plenty of movie studios and a well structured education center, market will never be an issue as long as quality is provided. Georgia Tech, Emory, University of Georgia and Georgia state are just some of the institutions providing plenty of market.

- Corporate are also shifting base and opening new branches in Atlanta. They include Google, eBay and Porshe, all whom will bring a sizable number of clientele. This another enticing reason to buy Atlanta investment properties.

- A majority of publications, including CNN Money, Forbes, and Kiplinger magazines have rated Atlanta, GA as the most promising city and the best city to invest in. Hence, you can consider investing in Atlanta investment properties without any doubt.

- Presence of a vast number of fortune 500 companies, the weather and support from local authorities are just some of the criteria used in considering to invest in Atlanta investment properties.

- Other key metrics that were considered include, 1. Average home price: $234,249 2. 3-year population growth: 4.9% 3. 2-year job growth: 5.1% 4. 1-year home price growth: 8% 5. 3-year price growth forecast: 24% 6. Homes are undervalued by 7% compared to the ratio of price and local income.

- According to Trulia, median home values in Atlanta grew by 11 percent in last year alone, and most experts and economic predictors suggest this growth will continue for the foreseeable future. This is great sign for the Atlanta Housing Market.

- Due to increased population and low inventory, rental rates in the Atlanta area are on the rise. Thus, there is a potential for greater cash flow for investment properties in Atlanta.

- Low inflation of overhead expenses of investment properties such as insurance and maintenance costs. The value of real estate in Atlanta has historically increased at a higher rate than the rate of inflation. You are thereby ensuring that your “real” or hard asset in Atlanta will help maintain your wealth and your standard of living.

- Real estate investing allows for several tax deductions.The cost of financing and operating your property can be deducted from the income you earn. This includes mortgage interest, property taxes, property management fees (if applicable), repairs, maintenance, and other related expenses that can be deducted from your gross rental income, thus minimizing the amount of tax you will pay.

- According to AJC.com, Atlanta has been the number one moving destination for the past six years. It may be surprising that the suburbs in Atlanta are experiencing a lot of growth – not just the metropolitan area.

- Some of the best areas in the Atlanta Housing Market are Midtown, Buckhead, Sandy Springs, Vinings, Dunwoody, etc A lot of businesses are located there so its easier to rent out the property plus the value goes up pretty fast.

- The median value of the homes in Buckhead Heights is $250,500, twice as large as the national average. On the other hand, the median rent is at $ 1,785. Buckhead Heights suburb is ranked one of the best in Atlanta Real Estate Market.

- Midtown Atlanta is the second largest business district in the city of Atlanta, situated between the commercial and financial districts of Downtown to the south and Buckhead to the north. The median home value of Midtown Atlanta is at $276,125. Median rental price, on the other hand, is $1,224. 56% of its population chose to rent their homes, while the remaining 44% own it.

- The current trend of turning industrial buildings into trendy apartments has increased the number of potential investment properties for sale in Atlanta.

- Atlanta, GA has most diverse employment Base and it is its greatest economic asset.

- 14,453 job were created through Invest in Atlanta Programs in 2017.

- Top Polymer Enterprise plans to initially create 70 jobs and invest $15 million in its new plant. The facility will be the first in the United States for the company, which exports to more than 30 countries.

- Many corporate relocations are underway to the metro Atlanta, such as IT headquarters for GE Digital and a distribution center for the Variety Wholesalers subsidiary, Roses and Maxway.

Atlanta Real Estate Investing: The Conclusion

Purchasing the best investment properties in Atlanta appears to be on the pricier end in 2020. However, this is because you’re also purchasing other positive aspects of the estate such as security, and community diversity.

You’re paying for a quality real estate in Atlanta when you decide to buy investment properties in the neighborhoods listed above. One disadvantage may come from families looking for premier schools for their children.

Most of the schools surrounding the neighborhoods listed in this article are given ratings of B on Niche.com. Considerably, it may be a not so good decision for parents who want their children to attend the best schools in the country.

That being said, Atlanta appears to be a wise choice of city for the youth. In many of the above mentioned neighborhoods, their residents seem to be young adults, based on their educational attainment. Likewise, Atlanta has come to be a bustling economic center.

When looking for the best real estate investments in Atlanta, you should focus on neighborhoods with relatively high population density and employment growth. We’ve already listed above some of the best neighborhoods to buy Atlanta investment properties.

You must also collaborate and learn from savvy real estate investors who have retired early on in their lives by investing in some of the best real estate markets like Atlanta, GA.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process.

They are well-informed about critical factors that affect your specific market area, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

The aim of this article was to educate investors who are keen to buy investment properties in Atlanta in 2020. Purchasing an investment property requires a lot of studies, planning, and budgeting. Not all deals are solid investments. We always recommend to do your own research and take help of a real estate investment counselor.

*Remember, caveat emptor still applies when buying a property anywhere. Some of the information contained in this article was pulled from third party sites mentioned under references. Although the information is believed to be reliable, Norada Real Estate Investments makes no representations, warranties, or guarantees, either express or implied, as to whether the information presented is accurate, reliable, or current. All information presented should be independently verified through the references given below. As a general policy, the Norada Real Estate Investments makes no claims or assertions about the future housing market conditions across the US.

References:

https://patch.com/georgia/atlanta/atlanta-housing-market-among-best-invest-2018-forbes http://www.noradarealestate.com/blog/benefits-of-investing-in-real-estate/ https://www.investatlanta.com/ https://www.homeunion.com/market-research/atlanta-market-research/

http://www.mccrearyrealty.com/blog/5-things-to-know-about-investing-in-the-atlanta-real-estate-market/