Many folks are wondering what's on the horizon for interest rates in the coming years, and there's a lot of buzz surrounding the predictions from big financial players. One of the most closely watched is Goldman Sachs, and their outlook for 2025 and 2026 offers some intriguing insights. Based on my read of their analysis, Goldman Sachs anticipates the Federal Reserve will likely cut interest rates by the end of 2025, and continue with further adjustments in 2026, aiming for a more sustainable economic balance.

Goldman Sachs Interest Rate Predictions for 2025 and 2026

It's no secret that the Federal Reserve (often called “the Fed”) has been in a delicate balancing act. After a period of raising rates to combat inflation, the talk has shifted towards when and how much they might start to ease them back. Fed Chair Jerome Powell has been careful with his words, emphasizing that decisions aren't set in stone and that different opinions exist within the Federal Open Market Committee (FOMC). Yet, despite some hawkish undertones, Goldman Sachs Research maintains its forecast. They believe the data points towards a December 2025 rate cut, even if Powell himself suggested it's “far from” a done deal.

Understanding the Fed's Thinking: Inflation Close, Jobs Cooling

So, what's driving Goldman Sachs' prediction? It boils down to two key areas: inflation and the job market. Powell himself has hinted that inflation, when you strip out certain effects like tariffs, is getting pretty close to the Fed's 2% target. This is crucial because keeping inflation in check is the Fed’s primary mission.

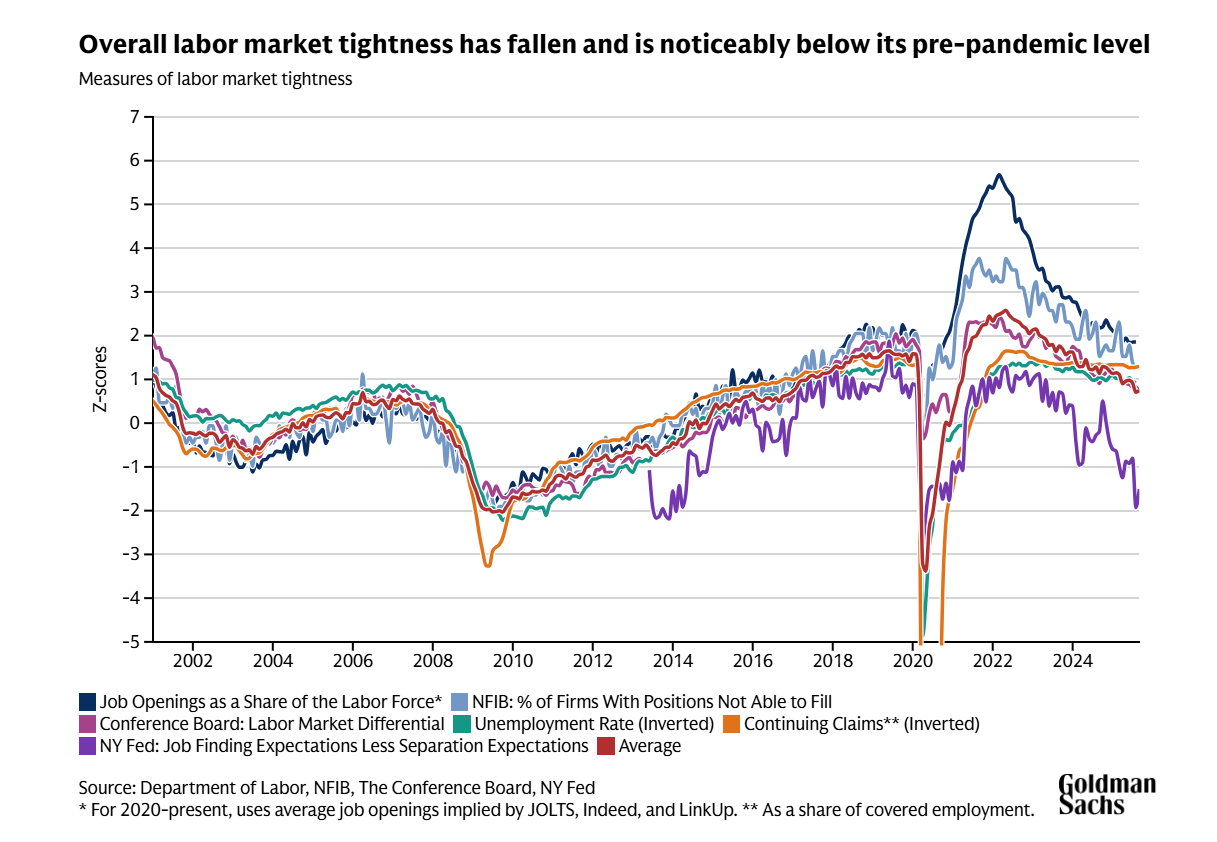

On the flip side, the labor market, which has been super tight for a while, is finally showing signs of gradual cooling. This cooling is precisely what the Fed wants to see. As the chart below illustrates, various measures of labor market tightness have fallen below their pre-pandemic levels. This suggests that the intense competition for workers is easing, which can help put less upward pressure on wages and, by extension, inflation.

Measures of Labor Market Tightness (2002-2024)

(This chart shows several indicators all trending downwards, indicating a less strained job market compared to recent years.)

- Job Openings as a Share of the Labor Force: Decreasing.

- NFIB: % of Firms With Positions Not Able to Fill: Falling.

- Conference Board: Labor Market Differential: Lower.

- Unemployment Rate (Inverted): While inverted charts can be tricky, the trend indicates a normalization. The actual unemployment rate has been rising slightly.

- NY Fed: Job Finding Expectations Less Separation Expectations: Narrowing.

- Continuing Claims (Inverted): Similar to the unemployment rate, the trend suggests a return to more normal levels.

Goldman Sachs Research looks at this data and sees that the weakness in the job market isn't just a temporary blip; they believe it's genuine. They don't expect the employment picture to change dramatically enough by the December 2025 meeting to make the FOMC decide against cutting rates.

Why a December 2025 Cut is Still On the Table

Even though Fed Chair Powell's recent press conference had a slightly more cautious tone than some expected, Goldman Sachs Chief US Economist David Mericle stands firm. He acknowledges that the conference played out a bit differently than their team anticipated, but their core forecast hasn't wavered. They still see that December rate cut as quite likely.

Mericle points out something interesting: there seems to be significant opposition within the FOMC to what they call “risk management cuts.” These are essentially proactive rate cuts meant to stave off potential economic trouble. Mericle suggests that Powell might have felt it was important to voice these internal concerns during his press conference, perhaps to manage expectations or show that the committee is considering all viewpoints.

Here's my take on it: Powell's careful wording is typical. He's like a skilled chess player, thinking several moves ahead and aware of all the different player strategies (or committee member opinions). While he might acknowledge the “wait-a-cycle” crowd, the underlying economic data—especially the cooling job market and inflation nearing the target—still supports a move to ease policy. Goldman Sachs seems to be reading the tea leaves, focusing on the data trends that point towards an easing cycle.

Looking Ahead: 2026 and Beyond

But what about 2026? Goldman Sachs isn't stopping at just one cut. They're projecting two more quarter-percentage-point (25-basis-point) cuts in March and June of 2026. This would bring their estimated terminal rate—the peak or trough of the interest rate cycle—down to a range of 3% to 3.25%.

This projection suggests that the Fed, in Goldman Sachs' view, won't just cut rates once and then pause indefinitely. They foresee a continued, albeit measured, easing path throughout the first half of 2026. This implies that the economic forces guiding the Fed's hand will likely continue to push towards lower rates for a sustained period.

Key Factors for Future Rate Decisions:

- Inflation Trajectory: Will it stay near the 2% target, or are there risks of it ticking up again?

- Labor Market Health: Will the cooling continue steadily, or will there be unexpected shifts?

- Global Economic Conditions: International events can always influence the Fed's decisions.

- Fiscal Policy: Government spending and tax policies can also impact the economy and interest rates.

The Role of Data (and Lack Thereof)

It's worth noting that the economic data landscape can be choppy. Government shutdowns, for example, can temporarily halt the release of official statistics. Powell acknowledged that some FOMC participants might see this lack of data and increased uncertainty as a reason to pause. It's a valid point: making significant policy changes without the clearest picture can be risky. However, Goldman Sachs believes the existing trends are strong enough. They expect that labor market data by December 2025 simply won't provide a “convincingly reassuring message” for those who want to hold off on cuts.

Furthermore, Mericle highlights that the Fed's own monetary policy is currently considered modestly restrictive. This restriction is helping to cool the labor market. Since the FOMC doesn't necessarily want further significant cooling to the point of widespread job losses, maintaining or even slightly reducing that restrictive stance via a rate cut makes logical sense. It's a way to achieve their goal of a balanced economy without tipping it into a downturn.

My Perspective: A Calculated Approach

From where I stand, Goldman Sachs' predictions paint a picture of a deliberate and data-driven Federal Reserve, guided by the strong desire to achieve its dual mandate (maximum employment and stable prices). While Fed officials like Powell will always hedge their bets and acknowledge dissenting views, the underlying economic momentum often dictates the path.

The cooling labor market is a significant signal. It means the Fed has more room to maneuver on interest rates without risking overheating the economy or causing a sharp rise in unemployment. The gradual approach to cuts—first in late 2025 and then into 2026—suggests they are not looking for a dramatic policy reversal, but rather a careful recalibration of monetary policy.

For anyone trying to make sense of financial markets, keeping an eye on Goldman Sachs' interest rate predictions for 2025 and 2026 is a smart move. They are known for their in-depth research and analytical prowess. While no one has a crystal ball, their forecasts provide a valuable framework for understanding the potential direction of interest rates and the economic forces at play.

Plan Smart Around Rate Forecasts – 2025 & 2026

With Goldman Sachs projecting interest rate shifts through 2025–2026, now is the time to lock in investment-grade real estate.

Norada offers high-yield turnkey properties designed to deliver stable cash flow and long-term equity growth—regardless of rate movements.

HOT NEW LISTINGS JUST ADDED!

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Recommended Read:

- Interest Rate Predictions for the Next 2 Years Ending 2027

- Interest Rate Predictions for 2025 and 2026 by Morgan Stanley

- Interest Rates Predictions for the Next 3 Years

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Interest Rate Predictions for the Next 10 Years: 2025-2035

- Interest Rate Predictions for the Next 12 Months

- Interest Rate Forecast for Next 5 Years: Mortgages and Savings

- When is the Next Fed Meeting on Interest Rates?

- Interest Rate Cuts: Citi vs. JP Morgan – Who is Right on Predictions?

- More Predictions Point Towards Higher for Longer Interest Rates