As the Federal Reserve's Open Market Committee (FOMC) deliberates during its meeting that concludes today, October 29, 2025, the financial world is practically holding its breath in anticipation. The consensus among Wall Street and the broader economic community is overwhelmingly focused on a 25 basis point reduction in the federal funds rate, bringing the target range down to 3.75%-4.00%.

This anticipated move, expected to be announced after the meeting, would represent the second consecutive cut this year and signal a proactive stance against potential weakening in the job market. It’s been a wild ride with interest rates over the past few years. We went from near-zero after the pandemic to sky-high levels to fight inflation, and now we seem to be shifting back toward easier money. This October meeting feels like a crucial step in that ongoing journey.

Interest Rate Predictions for October 29, 2025: Fed Rate Cut Odds Soar to 99%

The Driving Forces Behind the Expected Cut

So, why is everyone so sure a cut is coming as the FOMC deliberates? It boils down to a few key economic ingredients that are shaping their discussions.

1. A Cooling Job Market: This is the big one that's undoubtedly on the Fed's minds. We're seeing signs that the hiring spree might be slowing down. Private sector reports for September showed only modest job gains, and unemployment claims have been on the rise. This isn't just a hunch; it’s a trend that the Federal Reserve closely monitors. They have a dual mandate: maximum employment and stable prices. When the employment side shows cracks, they tend to act.

2. Inflation is Still a Friend, But a Wary One: Inflation, while not completely vanquished, has shown signs of easing. September's Consumer Price Index (CPI) reported a 3.0% year-over-year increase, a slight tick up from August but still a far cry from the peak. Core inflation, which strips out volatile food and energy prices, also eased a bit. While it's still above the Fed's target of 2%, the trend is moving in the right direction, giving policymakers room to breathe and consider cuts as they finalize their decisions.

3. The Fog of the Government Shutdown: A significant wildcard for this particular meeting has been the ongoing government shutdown. This has unfortunately put many key government reports, especially those from the Bureau of Labor Statistics (BLS), on hold. This means the Fed is working with less complete information than usual as they conclude their deliberations. Imagine trying to navigate a road with patches of fog – you have to rely on your best judgment and the information you do have. That's essentially what the Fed is doing right now, and the available data points toward needing to ease policy.

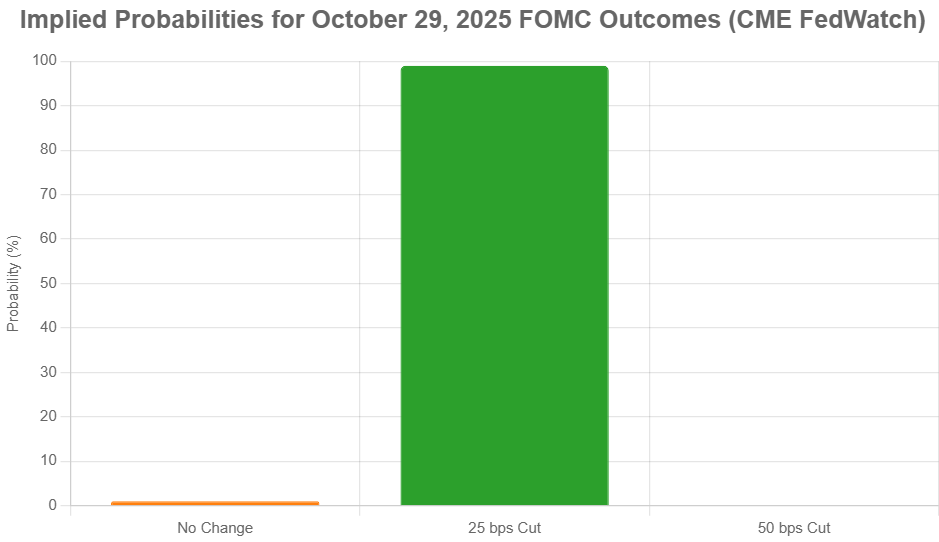

What the Markets Are Saying: A Roaring Consensus

When we talk about “market predictions,” we're often looking at tools like the CME FedWatch Tool. This nifty gadget uses futures contracts to show the probability of different Fed actions. For the imminent announcement at the conclusion of the meeting on October 29, 2025, the odds are astonishingly high: 99% probability for a 25 basis point cut. This means that for all intents and purposes, the market believes it's a done deal. The remaining 1% is likely for a hold or, even more improbably, a larger cut. This level of certainty is rare and speaks volumes about how confident the market is in the Fed's direction as they finalizetheir statement.

The sentiment doesn't stop there. Markets are also assigning a high likelihood – 94% probability – for another rate cut at the December 2025 meeting. This suggests that the Fed isn't just looking at a one-and-done situation but sees a path toward further easing by the end of the year, potentially bringing the federal funds rate down to the 3.50%-3.75% range.

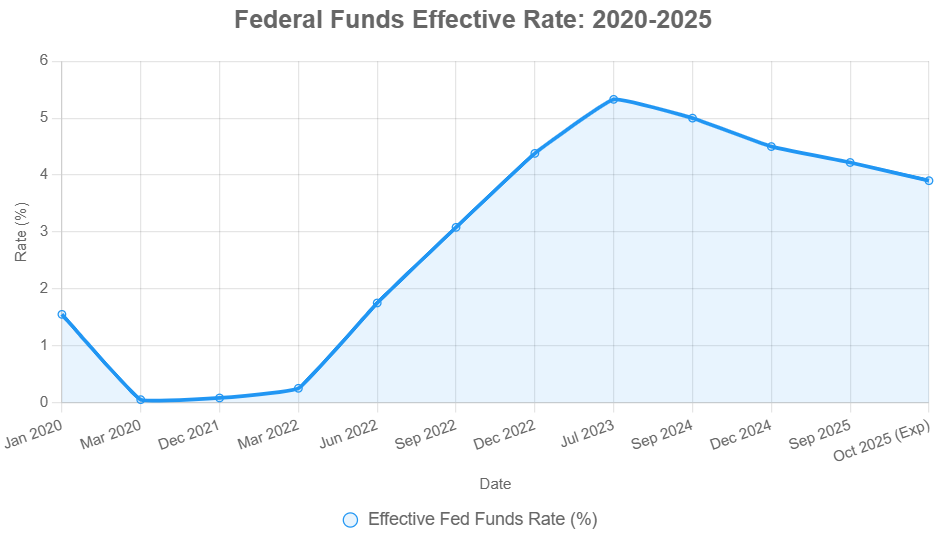

A Look Back: The Fed's Journey to This Point

To truly understand today's predictions as the FOMC meeting concludes, we need a little historical context. The Fed's journey in 2025 has been about carefully unwinding the aggressive rate hikes of previous years. After peaking around 5.25%-5.50% in mid-2024 to combat post-pandemic inflation, the Fed began a series of moves aimed at bringing borrowing costs down.

- September 2024: A significant 50 basis point cut kicked off the easing cycle.

- November & December 2024: Two more 25 basis point reductions followed, bringing rates to 4.25%-4.50% by the start of 2025.

- Early to Mid-2025: The Fed held rates steady through several meetings, carefully watching inflation and economic growth as they prepared for this current discussion.

- September 17, 2025: The most recent move was a 25 basis point cut, bringing the target range to its current 4.00%-4.25%. This decision was driven by those early signs of labor market softness that are now central to their current deliberations.

| Date | Target Range | Change (bps) | Key Notes |

|---|---|---|---|

| Sep 17, 2025 | 4.00%-4.25% | -25 | Miran dissents for -50 bps; labor cooling cited. |

| Jul 30, 2025 | 4.25%-4.50% | 0 | Bowman, Waller prefer -25 bps. |

| Jun 18, 2025 | 4.25%-4.50% | 0 | Unanimous hold amid stable growth. |

| May 7, 2025 | 4.25%-4.50% | 0 | Focus on inflation monitoring. |

| Mar 19, 2025 | 4.25%-4.50% | 0 | Waller notes QT pace; unanimous. |

| Jan 29, 2025 | 4.25%-4.50% | 0 | Labor strong, activity moderate. |

| Dec 18, 2024 | 4.25%-4.50% | -25 | Hammack prefers hold. |

| Nov 7, 2024 | 4.50%-4.75% | -25 | Unanimous easing. |

| Sep 18, 2024 | 4.75%-5.00% | -50 | Bowman prefers -25 bps. |

| Jul 31, 2024 | 5.25%-5.50% | 0 | Peak rate maintained. |

This pattern of easing from a higher peak mirrors historical cycles, but each one has its own unique characteristics shaped by the economic environment, all coming to a head in today's crucial meeting.

Here's a graph showing how the fed funds rate has evolved:

This historical context is crucial. It shows that the Fed’s actions are part of a process, and the October meeting is another step in that ongoing journey.

The Impact of a Rate Cut: What It Means for You

When the Fed is expected to cut interest rates, it's like turning a faucet for the cost of borrowing money. Here's how it can affect different parts of your financial life once the decision is announced:

- Borrowers Rejoice (Potentially):

- Mortgages: Mortgage rates are closely tied to the Fed's actions. With current 30-year mortgage rates hovering around 6.5%, a cut could push them slightly lower, perhaps to mid-6% range. This can make buying a home more affordable or lead to savings for those looking to refinance.

- Car Loans and Credit Cards: The cost of borrowing for other big purchases might also decrease over time.

- Savers Face a Squeeze:

- Savings Accounts and CDs: On the flip side, the interest you earn on your savings accounts, money market accounts, and Certificates of Deposit (CDs) will likely decline. If rates drop by 0.25%, you might see a similar reduction in your yields. This is something retirees and those relying on interest income should be aware of.

- The Stock Market's Reaction:

- Potential Boost: Cheaper borrowing costs can make it more attractive for companies to invest and expand, potentially leading to higher stock prices. A rate cut often provides a positive sentiment boost to the market.

- Bond Volatility: Bond prices can be a bit more complex. If the Fed signals more aggressive cuts in the future, bond yields (which move inversely to prices) might decline.

- The Broader Economy:

- Stimulus Effect: Easier monetary policy generally encourages spending and investment, which can help keep the economy growing.

- Asset Bubbles: However, if rates stay low for too long without economic justification, there's a risk of inflating asset bubbles in things like stocks or real estate.

Navigating the Shutdown's Shadow

The government shutdown presents a unique challenge for the Fed as they finalize their discussions. With core economic data delayed or unavailable, they’re relying more heavily on alternative indicators and anecdotal evidence. Think of it like trying to play a game of chess with some of the pieces hidden – you have to anticipate your opponent's moves based on what you can see. This lack of definitive data might make future decisions a bit more uncertain, but for this October meeting's announcement, the evidence for a cut is just too strong to ignore.

Expert Opinions: A Mix of Caution and Consensus

While the market is almost unanimous in its prediction, experts offer more nuanced views as the Fed reaches its conclusion. Some, like former Federal Reserve officials, acknowledge that the available alternative data supports the rationale for a cut. Others express caution, pointing out that while inflation is easing, it’s still above the target, and the labor market's full potential weakness might take time to fully reveal itself. There's also the ongoing debate about how quickly the Fed should cut rates in the coming months, a discussion likely happening right now behind closed doors.

The Path Ahead: What to Expect Beyond Today's Announcement

The October cut is largely baked in, but the announcement itself is still the key event. The real question now shifts to what happens next. Will the Fed continue cutting at a steady pace? Will there be a pause? What will inflation and the job market do in the coming months, especially as more data becomes available after the shutdown ends?

Here's what I'm keeping an eye on after the FOMC statement is released:

- December Meeting: As mentioned, the probability of another cut in December is very high. Policymakers will be closely watching how the economy responds to today's cut and any new data that emerges.

- Inflation Data: The path of inflation, particularly core inflation and shelter costs, will remain paramount. Any unexpected reacceleration could put a halt to the cutting cycle.

- Labor Market Trends: We need to see the official September jobs report and subsequent data to get a clearer picture of employment trends. Signs of a sustained slowdown will likely prompt further action.

- Fed Communication: Fed Chair Jerome Powell's press conference, which follows the announcement, will be crucial for deciphering the Fed's future intentions. He'll likely emphasize “data dependence,” meaning their decisions will be guided by incoming economic information.

My Take on It All

From where I stand, this expected October 29, 2025 rate cut feels like a necessary step to support an economy that's showing some signs of strain as the FOMC concludes its deliberations. The Fed has done a remarkable job in trying to thread the needle between fighting inflation and ensuring maximum employment.

While there are always risks and uncertainties, especially with incomplete data due to the shutdown, the overwhelming market sentiment and the available economic indicators point toward a move towards lower interest rates as the announcement imminently approaches. For consumers, this means potentially cheaper borrowing costs but also lower returns on savings. It’s a complex balance, and as always, I’ll be watching closely to see how these decisions unfold and what they mean for our bottom lines.

“Build Wealth Faster Through Turnkey Real Estate”

The Federal Reserve’s decisions on interest rates impact everything—from your mortgage payments to your savings yields. Market analysts now anticipate additional rate cuts over the coming months—potentially lowering the rate to around 3.50%–3.75% by the end of 2025.

This shift could open new opportunities for homebuyers and real estate investors looking to secure better financing terms.

🔥 Lower Rates Mean Smarter Investment Opportunities! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More?

Explore these related articles for even more insights:

- Next Federal Reserve Meeting Just 4 Days Away: What to Expect?

- Fed Interest Rate Forecast Q4 2025: Target Range Could Hit 3.50%–3.75%

- Fed Interest Rate Forecast for the Next 12 Months

- Federal Reserve Cuts Interest Rate by 0.25%: Two More Cuts Expected in 2025

- Interest Rate Predictions for the Next 3 Years: 2025, 2026, 2027

- When is Fed's Next Meeting on Interest Rate Decision in 2025?

- Interest Rate Predictions for the Next 10 Years: 2025-2035

- Interest Rate Predictions for 2025 by JP Morgan Strategists

- Interest Rate Predictions for Next 2 Years: Expert Forecast

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Impact of Interest Rate Cut on Mortgages, Car Loans, and Your Wallet