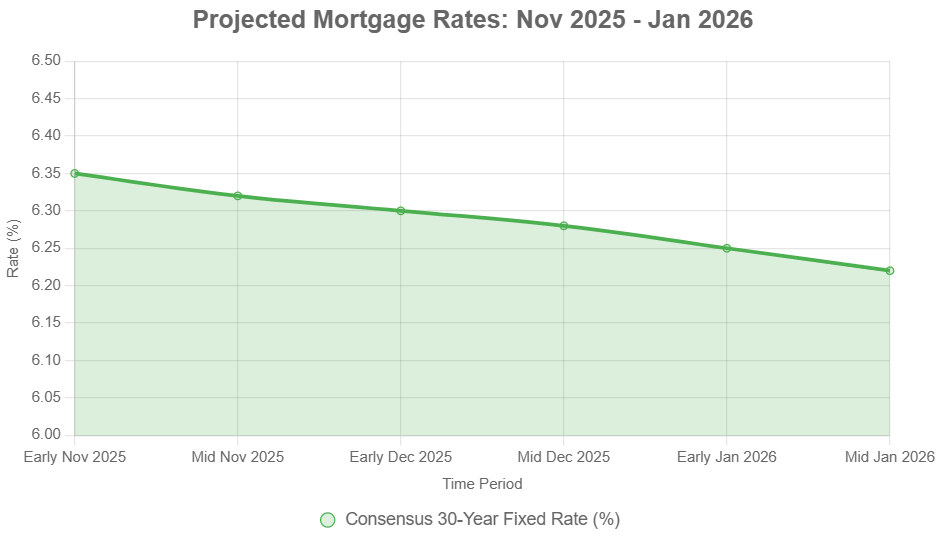

If you're wondering about mortgage rate predictions for the next 90 days, from November 2025 to January 2026, here's the good news: I expect we'll see a modest, gradual decline. While not a huge drop, this easing could provide a breath of fresh air for buyers and refinancers, with rates likely settling in the 6.2% to 6.4% range for a 30-year fixed loan, potentially dipping a bit more by early 2026 if the economy cooperates.

Mortgage rates are always a bit unpredictable—kind of like the weather. As we head into November 2025, everyone’s watching to see what the next 90 days will bring. That stretch takes us through the end of the year and into early 2026, and most of the experts I follow expect things to stay relatively steady, maybe even tilt slightly lower. It’s not a dramatic drop, but it could be just enough to help buyers and refinancers make their move.

Mortgage Rates Predictions for the Next 90 Days: Nov 2025 to Jan 2026

Where We're At: Current Mortgage Rate Snapshot

As of today, November 5, 2025, the average rate for the ever-popular 30-year fixed mortgage is sitting right around 6.2%. This feels like a significant improvement compared to where we were just earlier this year, when rates were flirting with the 7% mark. It's a reflection of the Federal Reserve's recent moves, including a couple of 25-basis-point cuts to the federal funds rate, nudging it down to the 3.75%-4.00% band.

For those looking for a faster path to owning their home outright, the 15-year fixed mortgage is currently averaging around 5.6%. That said, it's important to remember that rates fluctuate daily, and what you see in national averages might differ slightly from what you're offered based on your credit score, loan type, and the lender you choose. For instance, Freddie Mac data shows rates trending downwards for four weeks in a row through late October, but we've seen a little hiccup this week with some minor upticks as the market gets jittery.

Here's a quick look at where things stand today, according to various sources:

| Loan Type | Current Rate (Nov 5, 2025) | Latest Trend |

|---|---|---|

| 30-Year Fixed | ~6.20% | Slight downward momentum |

| 15-Year Fixed | ~5.60% | Stable with slight dips |

| FHA 30-Year | ~6.05% | Competitive, good for buyers with lower down payments |

| VA 30-Year | ~5.85% | Often better than conventional |

| 5/1 ARM | ~6.10% | Watchful eye on future rate hikes |

(Note: These are general averages. Always get personalized quotes.)

What the Experts Are Saying: Looking Ahead to Early 2026

When I look at the predictions from major financial institutions and housing organizations, a clear theme emerges: expect modest easing. The period from November 2025 through January 2026 is crucial, bridging the end of the year and the beginning of a new one.

- Fannie Mae is anticipating that by the end of 2025, we'll see rates around 6.3%, with a potential dip to 6.2% by the first quarter of 2026. They're tying this to the expectation of a couple more Fed rate cuts in the coming year.

- The Mortgage Bankers Association (MBA) has a slightly more conservative outlook, seeing Q4 2025 averaging 6.4% and holding steady into Q1 2026, with further moderation expected later down the line. They often have a good pulse on what lenders are doing.

- Other voices, like the National Association of Realtors (NAR), also believe we'll stay in the mid-6% range for now, but they hint at a possible slide towards 6.0% by the middle of 2026.

These forecasts generally assume that we won't face any major economic shocks. However, if things get unexpectedly rocky, or the opposite, surprisingly calm, rates could swing a bit wider, perhaps between 6.0% and 6.5%.

This is the kind of data I pore over. It's not about one single prediction, but how these respected organizations align and where their assumptions diverge. For instance, Fannie Mae's optimism often stems from intricate economic models predicting GDP growth, while the MBA's views are often grounded in direct feedback from a vast network of lenders. Considering both gives me a more rounded perspective.

The Balancing Act: What's Influencing Mortgage Rates?

It’s a complex dance, with various economic factors playing a role. Here are the big ones I'll be watching closely over the next 90 days:

- The Federal Reserve's Next Move: The Federal Reserve's December meeting is a huge event. Markets are currently pricing in a roughly 70% chance of another quarter-point rate cut. However, Fed Chair Jerome Powell has been quite clear about the caution being exercised. Mixed signals—like a strong jobs report alongside sticky inflation—could easily make the Fed pause or even consider a hike, though that seems less likely right now. This indecision creates the kind of volatility that keeps everyone on their toes. Personally, I believe the Fed will likely err on the side of caution rather than speed.

- Economic Signposts: We're looking for signs of a cooling economy, but not one that's falling off a cliff. A moderating labor market and lessening inflation would certainly support lower mortgage rates. But here's where things get tricky: the recent government shutdown, even if resolved, can delay crucial economic data. This lack of clarity can make markets nervous. We need to see consistent trends, not jumpy numbers.

- Treasury Yields and Global Ripples: The 10-year Treasury yield is often seen as the benchmark for mortgage rates, and it's currently around 4.1%. If this yield starts climbing, it can counteract any positive moves from the Fed. Plus, international events, from trade disputes to geopolitical rumblings, can have a surprisingly swift impact on bond markets and, by extension, mortgage rates.

- The Housing Market's Own Beat: We're still seeing low inventory of homes for sale in many areas, which keeps prices elevated. To make those high prices more accessible, mortgage rates can't be too scary. So, there's an indirect pressure for rates to ease, even if demand is strong. The holiday season usually brings a slight slowdown in housing activity, which can sometimes lead to temporary rate drops as lenders compete for business.

Related Topics:

Mortgage Rates Predictions for 2025 and 2026 by Fannie Mae

Mortgage Rates Predictions for the Next 12 Months: Nov 2025 to Nov 2026

Mortgage Rates Predictions for the Next 2 Years: 2026 and 2027

What This Means for You: Buyers and Refinancers

So, what does all this mean for you personally?

- For Prospective Buyers: If you've been on the fence, the next few months might offer a good window. Locking in a rate between 6.2% and 6.4% could be significantly better than what you might have faced earlier in the year. The holiday lull in competition might also work in your favor.

- For Those Looking to Refinance: If the forecasts hold true and rates nudge slightly lower by January 2026, refinancing could become more attractive. For a typical $300,000 loan, a small drop could translate to monthly savings somewhere between $50 and $100. It really depends on how much you can shave off your current rate. It might be worth waiting a bit if you're not in a rush.

The MBA predicts that improved affordability (even if gradual) could lift home sales by about 5-7% in the first quarter of 2026. That said, with more buyers potentially entering the market, we might also see home prices creep up by 2-3% in response. It's a delicate balance.

A Personal Take: Navigating the Data

From where I sit, after watching these markets for years, the most crucial thing to remember is that nobody has a crystal ball. While these forecasts are informed and based on rigorous analysis, unexpected events—like that surprise government shutdown I mentioned—can throw a wrench into everything.

I've seen periods where cautious optimism was warranted, and the market delivered. I've also seen times when the data looked promising, but external forces pushed rates up unexpectedly. The key lesson for me has been the importance of flexibility and preparedness.

The current environment feels like a “wait and see” scenario, but with a leaning towards positive movement. The Fed's actions are paramount, and their recent signals suggest a desire to manage inflation down without crashing the economy. This “soft landing” scenario is ideal for mortgage rates to settle into a more manageable range.

My advice is always to stay informed, but not to get paralyzed by trying to time the market perfectly. If you find a rate that significantly improves your financial situation, and it fits your long-term goals, it's often wise to consider locking it in. Waiting for the absolute bottom is a gamble that doesn't always pay off.

What to Watch For: Key Indicators to Track

Here are the specific things I'd be keeping an eye on as we move through November, December, and into January:

- Inflation Reports: Particularly the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) price index. These are the key metrics the Fed watches.

- Labor Market Data: Nonfarm payrolls, unemployment rate, and wage growth. We want this to cool gently, not collapse.

- Fed Speeches and Meeting Minutes: These often offer subtle clues about future policy directions.

- 10-Year Treasury Yield Movements: Watch for significant daily or weekly swings.

- Housing Market Sentiment Surveys: These can offer insight into builder and buyer confidence.

The Bottom Line: A Forecast of Modest Relief

Mortgage rate predictions for the next 90 days: November 2025 to January 2026 largely suggest a stable to slightly declining trend, with the 30-year fixed rate expected to hover in the 6.2%—6.4% range. While a dramatic drop isn't anticipated, the potential for a gradual easing by early 2026 offers a glimmer of hope for improving housing affordability.

My personal take is that the economic forces at play, particularly the Federal Reserve's cautious approach and the ongoing tug-of-war between inflation and employment, point towards this measured descent. It's a complex economic puzzle, but the pieces seem to be falling into a pattern of marginal relief.

Invest in Real Estate Before Rates Shift Again

With mortgage rates expected to stay steady—or even dip slightly—as we close out 2025, this could be the perfect window to lock in strong rental returns and build long-term wealth through real estate.

Work with Norada Real Estate to identify cash-flowing turnkey properties in resilient markets, so you can invest confidently before the next rate cycle begins.

HOT TURNKEY DEALS JUST LISTED!

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Mortgage Rates Predictions for the Latter Half of 2025 by Norada Real Estate

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Mortgage Rates Predictions by Top Industry Experts 2025-2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?