Naperville, Illinois, consistently ranks as one of the best places to live in the United States. With its vibrant downtown, excellent schools, and abundant green spaces, it's no wonder that the Naperville housing market is a popular choice for both families and young professionals.

Given the competitive landscape and limited inventory, the Naperville housing market predominantly favors sellers. With homes selling quickly and often above the list price, sellers enjoy favorable conditions poised to maximize their returns. However, buyers can still find opportunities in this market with the assistance of a knowledgeable real estate agent and a strategic approach.

The Naperville, Illinois housing market is expected to remain somewhat competitive in the upcoming spring buying season. However, buyers are likely to have more negotiating power than they did in the past.

Naperville Housing Market Trends in 2024

The Naperville, Illinois housing market continues to exhibit resilience and growth in February 2024, reflecting positive trends and promising opportunities for both buyers and sellers alike.

How is the Housing Market Doing Currently?

In February 2024, Naperville witnessed a notable surge in home prices, marking a 7.8% increase compared to the previous year. According to Redfin, the median price of homes soared to $550,000, underpinning robust growth in the region's real estate market. Moreover, homes in Naperville are selling swiftly, with an average of 57 days on the market, down from 63 days last year. This accelerated pace indicates high demand and competitive dynamics within the market.

Furthermore, the sales-to-list price ratio stands at an impressive 101.1%, reflecting strong buyer interest and competitive bidding. Notably, 45.7% of homes are selling above the list price, showcasing heightened competition among buyers.

How Competitive is the Naperville Housing Market?

The Naperville housing market is characterized by competitiveness, with homes typically selling in 49 days. This swift turnover underscores the desirability of properties in the area. Moreover, certain homes receive multiple offers, further intensifying competition among prospective buyers.

Interestingly, hot properties can command premiums, selling for approximately 3% above the list price and going pending in just 31 days. Such rapid transactions demonstrate the fervent demand for homes in Naperville.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite heightened demand, Naperville faces challenges in meeting the robust buyer demand. The inventory remains limited, with a modest 7.6% of homes experiencing price drops. This scarcity of inventory underscores the need for more listings to accommodate eager buyers.

Looking ahead, the future market outlook for Naperville appears promising, fueled by sustained demand and favorable conditions. While challenges such as inventory constraints persist, the resilient nature of the market bodes well for continued growth and stability.

Moreover, migration and relocation trends indicate sustained interest in the Naperville region. Despite some outflows, the majority of homebuyers express intent to remain within the metropolitan area, highlighting the allure and appeal of Naperville's vibrant community.

Naperville Housing Market Forecast 2024: Will it Crash?

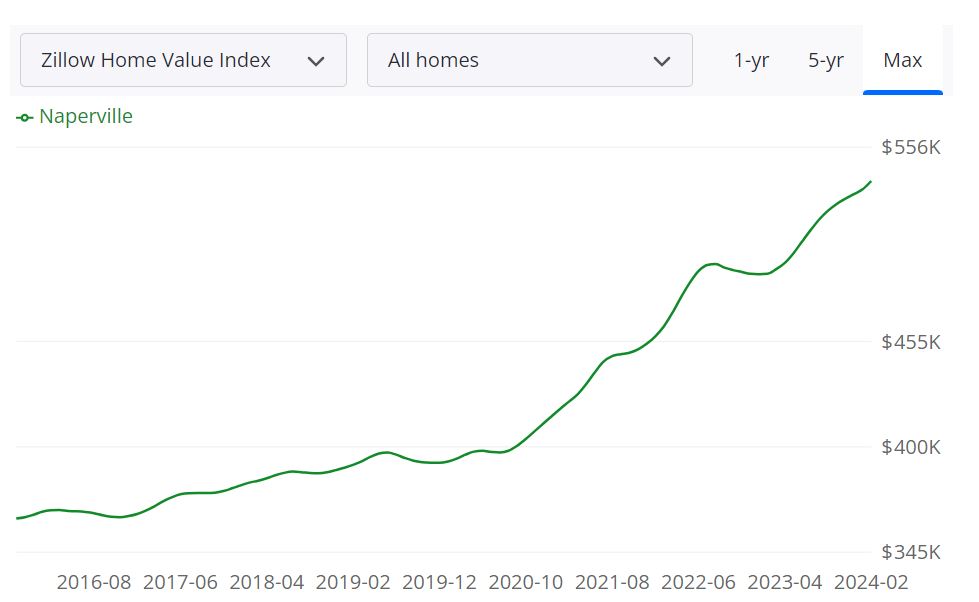

According to Zillow, the average Naperville home value stands at $538,826, marking a notable increase of 9.9% over the past year. Properties are swiftly going to pending status in approximately 8 days, underlining the pace of transactions in the area.

Key Housing Metrics Explained

- For Sale Inventory: As of February 29, 2024, there are 188 properties listed for sale in Naperville. This figure provides prospective buyers with an overview of the available options within the market.

- New Listings: The data as of February 29, 2024, indicates 84 new listings. These fresh entries into the market offer opportunities for both buyers and sellers, influencing the overall dynamics of supply and demand.

- Median Sale to List Ratio: With a median ratio of 0.995 as of January 31, 2024, this metric indicates the level of competitiveness in the Naperville housing market. A ratio nearing 1 suggests strong demand relative to listing prices.

- Median Sale Price: As of January 31, 2024, the median sale price stands at $483,667. This figure serves as a benchmark for both buyers and sellers, guiding negotiations and setting expectations.

- Median List Price: The median list price as of February 29, 2024, is $574,800. This represents the average asking price for properties in Naperville, reflecting the perceived value within the market.

- Percent of Sales Over List Price: Data from January 31, 2024, reveals that 38.2% of sales were concluded above the list price. This statistic underscores the competitive nature of the market, with buyers willing to pay premiums for desirable properties.

- Percent of Sales Under List Price: Conversely, 51.9% of sales as of January 31, 2024, were below the list price. This metric provides insight into the negotiating power of buyers and the flexibility within pricing.

Are Home Prices Dropping in Naperville?

Despite fluctuations in the housing market, data from sources like Zillow indicates that home prices in Naperville have been on an upward trajectory. The average home value has experienced a notable increase over the past year, suggesting a trend of appreciation rather than depreciation. While individual properties may experience price adjustments based on various factors such as location, condition, and market demand, the overall trend indicates price stability or growth rather than a significant decline.

Will the Naperville Housing Market Crash?

Speculation about a housing market crash often arises during periods of economic uncertainty or significant shifts in market conditions. While predicting market crashes with certainty is challenging, current indicators suggest a resilient Naperville housing market. Factors such as strong demand, limited inventory, and stable pricing trends contribute to the market's overall stability. However, it's essential to monitor economic indicators and market dynamics closely for any potential signs of instability.

Is Now a Good Time to Buy a House in Naperville?

For individuals considering purchasing a home in Naperville, assessing whether it's a good time to buy involves weighing various factors. While market conditions such as low inventory and high demand may pose challenges, low mortgage rates as compared to last year present opportunities for buyers to secure favorable financing. Additionally, factors such as personal financial readiness, long-term goals, and lifestyle considerations play a significant role in determining the right time to buy.

Should You Invest in the Naperville Real Estate Market?

Population Growth and Trends:

- Naperville has seen consistent population growth over the years, making it an attractive market for real estate investors. The city's appeal has led to an influx of residents, which can drive demand for housing, both for homeowners and renters.

- The city's population trends are characterized by a mix of young professionals, families, and retirees, providing a diverse pool of potential tenants. This diversity can help reduce vacancy rates and enhance the stability of your real estate investment.

Economy and Jobs:

- Naperville's economy is robust, with a strong job market and a variety of industries contributing to its success. The presence of several corporate headquarters and businesses creates a steady flow of employment opportunities, which can attract more residents and potential renters to the area.

- The local job market is diverse, including sectors such as healthcare, technology, education, and manufacturing. Diversification can be beneficial for real estate investors, as it reduces the risk associated with economic fluctuations in a single industry.

Livability and Other Factors:

- Naperville consistently ranks high in terms of livability factors, including excellent schools, low crime rates, and access to recreational amenities. These attributes make the city an appealing destination for families, contributing to the demand for both rental and ownership housing.

- The city's community-oriented culture and strong emphasis on safety make it an attractive place for people to settle down. This creates a stable pool of potential renters for real estate investors.

Rental Property Market Size and Growth:

- The rental property market in Naperville is substantial, catering to both long-term residents and short-term renters. With a growing population and an active job market, the demand for rental properties is likely to remain strong.

- The city's proximity to major urban centers, such as Chicago, enhances the appeal of Naperville as a rental market, as it attracts commuters and professionals seeking housing options outside the city.

Other Factors Related to Real Estate Investing:

- Naperville's real estate appreciation rates have historically shown positive growth. While past performance is not a guarantee of the future, it does indicate the potential for long-term gains for investors.

- The city's infrastructure and transportation networks are well-developed, making it easy for residents and renters to access the amenities and job opportunities both within Naperville and in neighboring cities.

- Investors should consider working with local real estate experts who have a deep understanding of the Naperville market, as well as staying informed about local regulations and property management best practices to maximize the potential of their investments.

References:

- https://www.zillow.com/naperville-il/home-values/

- https://www.redfin.com/city/29501/IL/Naperville/housing-market

- https://www.realtor.com/realestateandhomes-search/Naperville_IL/overview