While most of the headlines you'll see today will focus on the slight uptick in the popular 30-year fixed mortgage, the real story is happening with adjustable-rate loans. For mortgage rates today, the 5-year ARM plunges by 23 basis points – August 21, 2025, bringing the national average rate down to a compelling 7.09%.

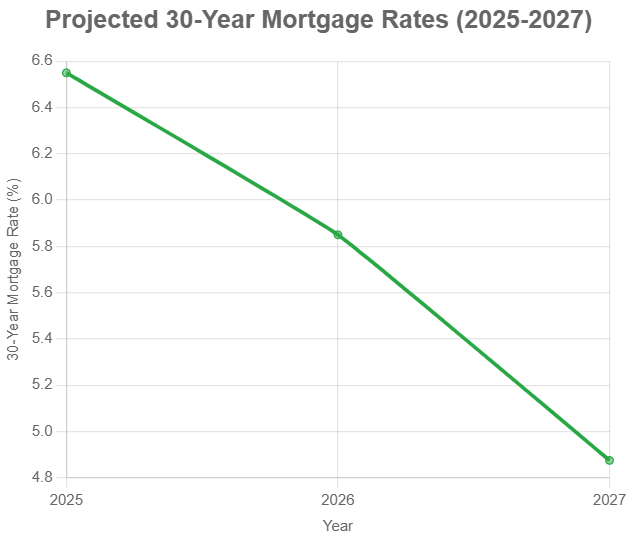

This significant drop comes as the average 30-year fixed rate nudged up by 4 basis points to 6.76%, creating a fascinating split in the market that savvy homebuyers should be watching closely. It’s a clear signal that the market is beginning to price in some long-awaited relief from the Federal Reserve.

Mortgage Rates Today: 5-Year Adjustable Rate Plunges by 23 Basis Points – August 21, 2025

In my years of watching the mortgage market, I've learned that you have to look beyond the headlines. The 30-year fixed rate is the king, no doubt. It’s stable, predictable, and what most Americans use to buy a home. But it's often a slow-moving giant. Adjustable-Rate Mortgages (ARMs), on the other hand, are like speedboats—they react much faster to the changing tides of economic expectation.

Today’s 23-basis-point drop in the 5-year ARM is a perfect example. A basis point is simply one-hundredth of a percentage point, so we're talking about a drop of 0.23%. While that might not sound like a lot, in the world of mortgages, it's a significant one-day move.

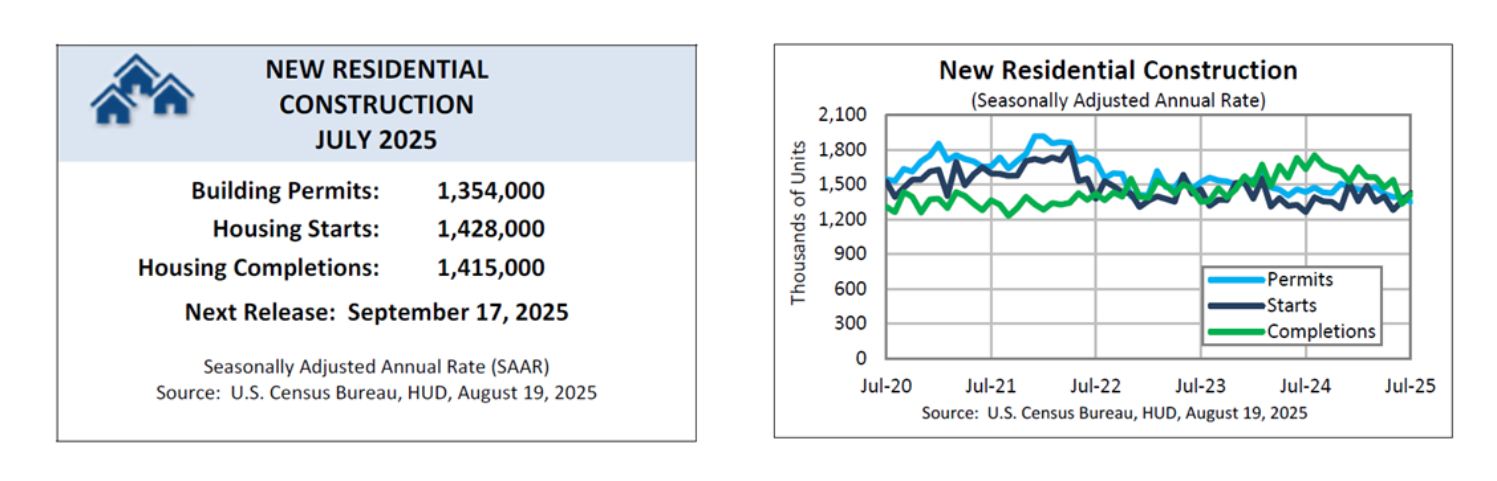

So, why the sudden dip? It’s all about anticipation. The market is overwhelmingly confident that the Federal Reserve is gearing up to cut its benchmark interest rate at its meeting next month. While fixed-rate mortgages are more closely tied to the long-term outlook of the economy (and the 10-year Treasury yield), ARMs are much more sensitive to short-term interest rate policy. Lenders are essentially betting on a lower-rate environment in the near future, and they are starting to price that optimism into their ARM products today.

A Quick Refresher: How Does an ARM Work?

If you’re not familiar with ARMs, they can seem a bit complicated, but the concept is straightforward. I always break it down for my clients like this:

- The Introductory Period: An ARM, like a 5-year ARM, has a fixed interest rate for an initial period (in this case, five years). Your payment won't change during this time.

- The Adjustment Period: After the intro period ends, the rate “adjusts” based on a specific financial index plus a margin set by the lender. This usually happens once a year.

- The Appeal: The initial rate on an ARM is often lower than on a 30-year fixed mortgage, which can mean a lower monthly payment for the first few years.

The drop we're seeing today makes that initial rate even more attractive, especially for certain types of buyers.

A Look at the Full Rate Board for August 21, 2025

While the ARM story is the most dynamic, let's take a look at the full picture. The 30-year fixed rate remains stubbornly high, and even the 15-year fixed rate is holding steady. This creates a “sticky” situation for many buyers who crave long-term predictability.

Here’s a snapshot of the national average rates for conforming loans today:

| PROGRAM | RATE | 1W CHANGE | APR | 1W CHANGE |

|---|---|---|---|---|

| 30-Year Fixed Rate | 6.76% | up 0.09% | 7.17% | up 0.04% |

| 20-Year Fixed Rate | 6.43% | down 0.24% | 6.90% | down 0.08% |

| 15-Year Fixed Rate | 5.80% | up 0.04% | 6.04% | down 0.03% |

| 10-Year Fixed Rate | 5.79% | up 0.31% | 6.09% | up 0.25% |

| 7-year ARM | 7.13% | down 0.40% | 7.60% | down 0.40% |

| 5-year ARM | 7.09% | down 0.15% | 7.63% | down 0.18% |

Data by Zillow. Last updated: 8/21/2025.

The standout numbers here are the drops in the 5-year and 7-year ARMs. It tells a clear story: the market is confident that rates will be lower in the medium term, even if the long-term outlook keeping 30-year rates high remains a bit cloudy.

The Elephant in the Room: What is the Federal Reserve Doing?

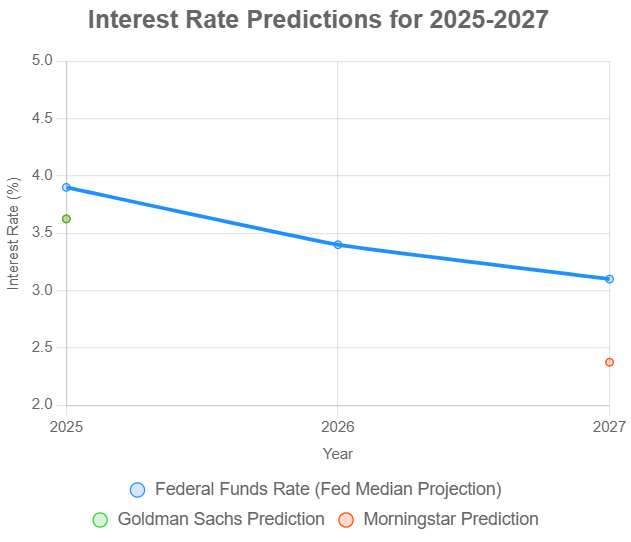

To understand why rates are behaving this way, we have to talk about the Federal Reserve. Their decisions cast a long shadow over the entire economy, and especially over the housing market.

The Great Pause of 2025

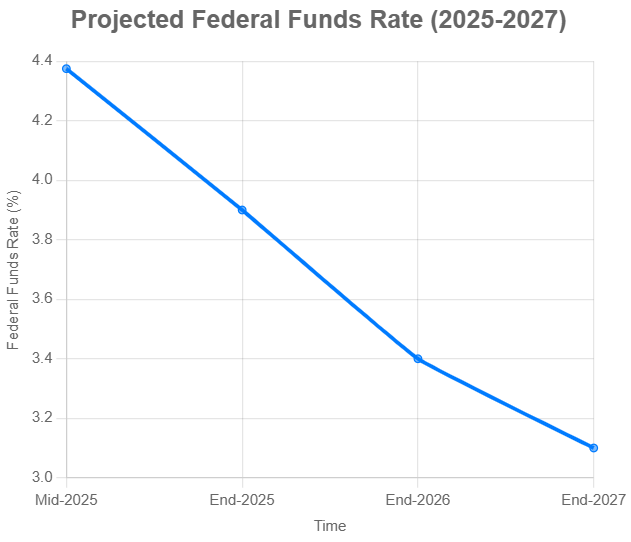

Remember the whirlwind of 2022 and 2023? The Fed went on a historic rate-hiking spree to crush runaway inflation. It worked, but it also sent mortgage rates soaring to two-decade highs. Then, in late 2024, they pivoted, delivering three quick rate cuts to steady the ship.

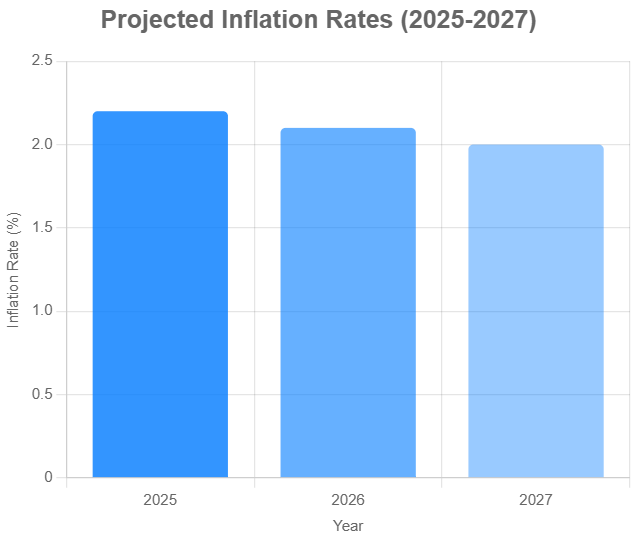

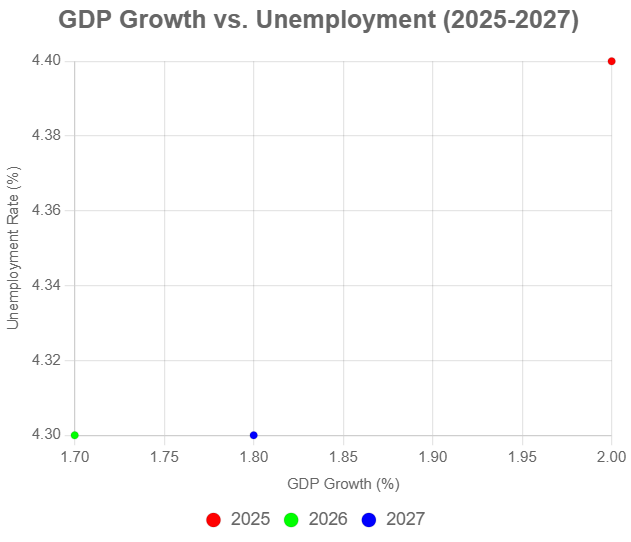

Since then, however, it's been a waiting game. We've gone through five straight Fed meetings in 2025 with no change. Why? The Fed has been walking a tightrope. On one side, you have slowing GDP growth and a cooling labor market (unemployment is now at 4.2%). On the other, you have stubborn inflation that just won't quite get back to their 2% target. It's been hovering around 2.7%, complicated by new tariff pressures.

Inside the Fed, there's even been some disagreement. At the last meeting in July, two governors actually voted for a rate cut, a sign that the pressure to act is building.

All Eyes on September

Now, it looks like the wait is almost over. All signs are pointing to a rate cut at the Fed's next meeting on September 16-17. Market indicators like the CME FedWatch Tool are showing an 85-95% probability of a cut.

Here’s why the market is so confident:

- Cooling Inflation: The latest Consumer Price Index (CPI) reading showed inflation moderating to 2.7%. It's not perfect, but it's moving in the right direction.

- Weakening Labor Market: The rise in unemployment gives the Fed the justification it needs to act to support the economy without worrying as much about overheating it.

- Economic Forecasts: Projections point to a continued economic slowdown, making a preemptive cut a prudent move.

Fed Chair Jerome Powell is speaking tomorrow at the Jackson Hole symposium, and you can bet everyone will be hanging on his every word for a final clue.

The Million-Dollar Question: Should You Consider an ARM Right Now?

This is where my experience as a market observer comes in handy. The data tells us what is happening, but the real question is what it means for you. An ARM isn't for everyone, but in this specific environment, it's becoming a very strategic tool for the right buyer.

Who Should Consider an ARM?

I typically see this work well for a few types of homebuyers:

- The Short-Term Homeowner: If you know you're likely to move or sell the property in five to seven years (perhaps for a job relocation or to upsize for a growing family), an ARM is a fantastic option. You can enjoy the lower initial rate and sell the home before the first rate adjustment ever hits.

- The High-Income Earner Expecting a Raise: If you are confident your income will rise significantly in the coming years, you may be comfortable with the risk of a higher payment down the line, knowing you can absorb it or refinance.

- The Strategic Refinancer: A buyer might take a 5-year ARM today with the explicit plan to refinance into a fixed-rate loan in a year or two, once the Fed's rate cuts have fully filtered through the system and brought 30-year fixed rates down. Today's ARM drop is a bet on that exact scenario.

Recommended Read:

5-Year Adjustable Rate Mortgage Update for August 19, 2025

Fixed vs. Adjustable Rate Mortgage in 2025: Which is Best for You

Who Should Stick with a Fixed-Rate Mortgage?

Despite the allure of a lower ARM rate, the peace of mind of a fixed-rate loan is unbeatable for many. You should probably stick with a fixed rate if:

- You're on a Tight Budget: If the thought of your monthly payment potentially increasing in five years makes you nervous, an ARM is not for you. Predictability is key.

- You Plan to Stay in Your Home for the Long Haul: If this is your “forever home,” locking in a rate for 30 years eliminates all future interest rate risk. You'll never have to worry about what the Fed is doing again.

- You are Risk-Averse: Some people just sleep better at night knowing their largest monthly expense will never change. There's absolutely nothing wrong with that!

Key Dates for Your Calendar

The next few weeks will be pivotal. Here’s what I’m watching:

- August 22: Fed Chair Powell's speech at Jackson Hole.

- September 16-17: The next Fed meeting, where a rate cut is highly anticipated.

- December Meeting: The likely opportunity for a second rate cut in 2025.

My Final Thoughts

Today’s mortgage rate news is a tale of two markets. The fixed-rate world is still stuck in the mud, waiting for a clear signal. But the adjustable-rate market is already sprinting ahead, anticipating the relief that seems to be just around the corner.

The 23-basis-point plunge in the 5-year ARM is more than just a number; it’s a strategic opportunity for the right buyer. It’s a chance to get a lower payment now while positioning yourself to refinance into a great fixed rate later. As always, the key is to understand your own financial situation, your timeline, and your tolerance for risk. The door on ARMs just opened a little wider—it’s worth taking a look inside.

Capitalize on ARM Rates Before They Rise Even Higher

With fluctuating adjustable-rate mortgages (ARMs), savvy investors are exploring flexible financing options to maximize returns.

Norada offers a curated selection of ready-to-rent properties in top markets, helping you capitalize on current mortgage trends and build long-term wealth.

HOT NEW LISTINGS JUST ADDED!

Connect with an investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Expect High Mortgage Rates Until 2026: Fannie Mae's 2-Year Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- Mortgage Rates Forecast for the Next 3 Years: 2025 to 2027

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?