Gilbert, Arizona, is a town brimming with potential for homebuyers and investors alike. Nestled amidst the stunning Sonoran Desert, Gilbert offers a vibrant community, excellent schools, and a booming job market, making it a highly sought-after destination. But what truly sets Gilbert apart is its thriving housing market, characterized by steady growth, diverse offerings, and a dynamic atmosphere.

Currently, Gilbert's housing market leans towards sellers, given the high demand and limited inventory. Sellers have the upper hand in negotiations, with homes selling close to or above the list price.

However, buyers still have opportunities in the market, especially for properties with longer days on the market or those in need of slight price adjustments. Working with a knowledgeable real estate agent can help buyers navigate the competitive landscape and secure their desired property.

Gilbert, AZ Housing Market Trends in 2024

How is the Housing Market Doing Currently?

According to Redfin, in February 2024, Gilbert's housing market demonstrated robust growth, with home prices soaring by 10.6% compared to the previous year. The median price for homes reached $574,000, which is 39% higher than the national average. This surge in prices reflects the high demand for properties in the area.

Moreover, homes in Gilbert are selling at a faster pace, spending an average of 40 days on the market, a significant improvement from 78 days last year. The increased pace indicates a heightened interest from buyers and a competitive market environment.

Furthermore, the number of homes sold in February rose to 238, up from 227 during the same period last year. This uptick in sales activity underscores the continued appeal of Gilbert's real estate market.

How Competitive is the Gilbert Housing Market?

Gilbert's housing market is moderately competitive, with some homes receiving multiple offers. On average, properties sell for approximately 2% below the list price, indicating a negotiation factor in transactions.

Additionally, the average time for homes to go pending is around 45 days, highlighting a sense of urgency among buyers. However, for highly desirable properties, the timeframe can be significantly shorter, with hot homes going pending in approximately 21 days.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite the competitive nature of the market, Gilbert has seen a slight increase in inventory, providing more options for buyers. However, the demand still outpaces the supply, driving prices upward.

Statistics reveal that 17.6% of homes are sold above the list price, indicating the willingness of buyers to pay a premium for desirable properties. Additionally, the sale-to-list price ratio stands at 98.6%, reflecting the strong negotiation power of sellers.

Nevertheless, there has been a slight decrease in homes with price drops, suggesting a stabilizing market where sellers are less inclined to reduce prices to attract buyers.

What is the Future Market Outlook for Gilbert?

The future outlook for Gilbert's housing market remains optimistic, fueled by continued demand and favorable economic conditions. While the rate of price appreciation may moderate, steady growth is anticipated in the coming months.

Migration and relocation trends indicate a sustained interest in Gilbert, with 76% of homebuyers looking to stay within the metropolitan area. Additionally, 3% of buyers from across the nation are searching to move into Gilbert, with Seattle leading as the top metro source.

Gilbert Housing Market Predictions for 2024 and 2025

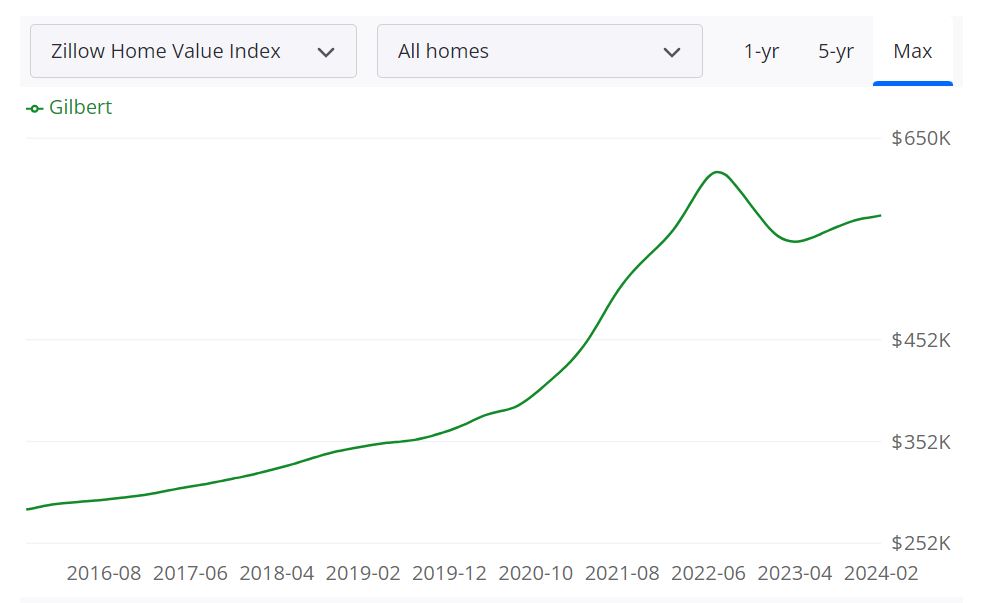

According to Zillow, a prominent real estate marketplace, the Gilbert housing market is showing signs of stability and growth, with several key metrics painting a picture of the current state of affairs.

Average Home Value and Appreciation

The average home value in Gilbert stands at $574,570, representing a modest increase of 3.6% over the past year. This figure reflects the median value of homes in the area, providing a baseline for property assessment and market analysis. Homeowners can track this metric to gauge the overall health of the housing market and the potential return on their investment.

Inventory and New Listings

As of February 29, 2024, Gilbert has 618 homes listed for sale, indicating the inventory available to prospective buyers. Additionally, 239 new listings entered the market during the same period, providing fresh opportunities for those in search of a new home. The balance between inventory and new listings is a critical factor in determining market competitiveness and pricing dynamics.

Median Sale and List Prices

The median sale price in Gilbert, recorded as $552,467 as of January 31, 2024, offers insight into the average transaction value within the market. Meanwhile, the median list price of $630,000 (as of February 29, 2024) represents sellers' expectations regarding property valuation and market demand. Analyzing the gap between sale and list prices can reveal trends in buyer-seller negotiations and pricing strategies.

Sale to List Ratio and Pricing Trends

The median sale to list ratio in Gilbert stands at 0.991, indicating that homes typically sell for approximately 99.1% of their list price. This metric offers valuable insights into the relationship between listing prices and actual sale prices, highlighting the level of demand and competition in the market. Furthermore, understanding the percent of sales over and under list price (17.2% and 57.9%, respectively, as of January 31, 2024) can shed light on pricing dynamics and buyer behavior.

Are Home Prices Dropping in Gilbert?

Despite fluctuations in the housing market, Gilbert has not experienced significant drops in home prices. The average home value, which currently stands at $574,570, reflects a modest appreciation of 3.6% over the past year. While individual properties may experience fluctuations based on factors such as location, condition, and market trends, the overall trend indicates stability in property values. Sellers can take comfort in the sustained demand for homes in Gilbert, while buyers may need to act quickly to secure properties at competitive prices.

Will the Gilbert Housing Market Crash?

As with any market, the possibility of a housing market crash is a concern for both industry professionals and consumers. However, current indicators suggest that Gilbert's housing market is resilient and unlikely to experience a sudden crash. Factors such as steady population growth, a diverse economy, and strong demand for housing contribute to market stability.

While minor fluctuations may occur in response to external factors such as economic downturns or shifts in consumer confidence, the overall outlook remains positive. Homeowners and buyers can mitigate risk by staying informed, working with trusted real estate professionals, and making decisions based on long-term financial goals.

Is Now a Good Time to Buy a House in Gilbert?

For individuals considering purchasing a home in Gilbert, the current market presents both opportunities and challenges. With interest rates remaining relatively low as compared to last year and a diverse inventory of homes available, now may be an advantageous time to buy for those who are financially prepared.

However, prospective buyers should be mindful of competition and potential price appreciation in certain segments of the market. Working with a knowledgeable real estate agent can help buyers navigate the complexities of the market and identify properties that align with their preferences and budget. Ultimately, the decision to buy a house should be based on individual circumstances, long-term goals, and a thorough understanding of market dynamics.

Is Gilbert a Good Place for Real Estate Investment?

Gilbert, Arizona, presents a compelling case for real estate investment, supported by several factors that make it an attractive destination for prospective investors.

Favorable Economic Environment

Gilbert boasts a strong and diverse economy, driven by a mix of industries including healthcare, education, technology, and manufacturing. The stable economy creates a conducive environment for real estate investment, ensuring a consistent demand for housing and commercial spaces.

Population Growth and Demand

The city has been experiencing a steady population growth due to its quality of life, excellent schools, and employment opportunities. A growing population typically indicates a rising demand for housing, which can lead to appreciation in property values, making it a promising area for real estate investment.

Quality of Life and Amenities

Gilbert is known for offering a high quality of life with safe neighborhoods, excellent schools, recreational facilities, and cultural attractions. These amenities make it an appealing location for families and professionals, enhancing the demand for residential properties.

Infrastructure Development

The city has made significant investments in infrastructure development, including transportation, utilities, and public services. These enhancements contribute to the overall appeal of the area, attracting potential investors and residents alike.

Stability in the Housing Market

While experiencing a modest decrease in home prices recently, Gilbert's housing market remains relatively stable and resilient. The competitive market, with homes selling quickly and a balanced median sale-to-list ratio, suggests a healthy real estate environment for both buyers and sellers.

Conclusion

Considering its robust economy, population growth, quality of life, infrastructure development, and stability in the housing market, Gilbert, Arizona, appears to be a promising location for real estate investment. However, like any investment decision, thorough research, careful assessment of market trends, and consultation with real estate professionals are essential to make an informed and successful investment.

References:

- https://www.zillow.com/Gilbert-az/home-values/

- https://www.redfin.com/city/6998/AZ/Gilbert/housing-market

- https://www.realtor.com/realestateandhomes-search/Gilbert_AZ/overview