Thinking about the California housing market often brings images of ever-climbing prices and fierce bidding wars. But what if I told you the tide might be turning for some areas? Based on recent Zillow forecasts, it looks like 31 major cities in california where home prices are predicted to fall by April 2026.

Yes, you read that right – a potential cooling off in a state famous for its red-hot property values. This isn't just a wild guess; it's based on data trends pointing towards a shift in the coming year or two. So, let's dive into what this could mean for you, whether you're a homeowner, a hopeful buyer, or just keeping an eye on the market.

California Housing Market Correction: Prices Expected to Drop in Over 30 Cities

The Bigger Picture: What's Happening Nationally?

Before we zoom into California, it's helpful to understand the national mood. Zillow's latest crystal ball gazing suggests a couple of interesting things for the U.S. housing market overall. They're predicting that existing home sales will actually increase a bit in 2025, but home values are likely to fall by 1.4% this year (that's 2025). This is a slight adjustment from an earlier prediction of a 1.9% decrease, so things are a tad less gloomy than previously thought, but still pointing downwards for prices.

Why the potential dip? A big reason is rising inventory. We're seeing more homes for sale, partly because sales have been a bit soft this spring. When buyers have more choices, sellers can't always call all the shots on price. It gives buyers a bit more breathing room and time to make decisions.

Now, buyers haven't exactly been rushing out in droves like they typically do in the spring. There's been some hesitation, likely due to economic uncertainty. We've all felt it, right? Wondering about inflation, interest rates, and the general direction of things. The good news is, Zillow thinks this uncertainty might have peaked.

So, for 2025, they're looking at existing home sales hitting around 4.12 million. That would be a 1.4% bump from 2024. It's a little less than they thought last month, but still an increase. What's propping this up?

- More houses on the market (supply)

- Policy uncertainty (like what the Fed might do with rates) hopefully calming down

- Small improvements in housing affordability

It seems like a mixed bag: more sales, but potentially lower prices. It's a market in transition, that's for sure.

California's Cooling Spell: Which Markets Are Facing a Dip?

Now, let's bring it home to California. The Golden State often marches to the beat of its own drum, but it's not immune to these broader trends. In fact, given how high prices have soared here, it makes sense that some areas might be more sensitive to shifts in affordability and buyer sentiment.

I've been watching California real estate for years, and one thing I've learned is that what goes up very, very fast can sometimes take a breather. This isn't necessarily a crash, but more of a market correction or normalization. Based on Zillow's data, here are the 31 metro areas in California, and their projected percentage price decline by April 2026, starting from a baseline of April 30, 2025:

| Region Name | Expected Price Decline by April 2026 (%) | My Quick Thoughts |

|---|---|---|

| Ukiah, CA | -7.6% | Smaller inland market, might be more sensitive to economic shifts. Big run-up, now a correction? |

| Eureka, CA | -6.3% | Coastal, but more remote. Similar dynamics to Ukiah perhaps. |

| San Francisco, CA | -5.2% | The tech hub has seen affordability stretched to its limits. Remote work impacts still settling. |

| Clearlake, CA | -4.9% | Often an affordability play relative to pricier Bay Area spots. |

| Santa Rosa, CA | -4.8% | Wine country, popular, but also got very expensive. |

| Chico, CA | -4.5% | University town, saw growth as people sought affordability. |

| Napa, CA | -4.1% | Luxury market, but even high-end can feel the pinch. |

| San Jose, CA | -3.8% | Silicon Valley's core. Similar to SF, affordability is a huge factor. |

| Vallejo, CA | -3.7% | Another Bay Area market that offered relative affordability, now seeing a pullback. |

| Red Bluff, CA | -3.7% | Northern California, smaller market. |

| Sonora, CA | -3.7% | Sierra foothills, popular for escape, but prices rose significantly. |

| Susanville, CA | -3.7% | Remote northeastern California. |

| Truckee, CA | -3.6% | Mountain resort town, boomed with remote work. Now some cooling? |

| Sacramento, CA | -3.0% | Became a hotspot for Bay Area émigrés. That wave might be slowing. |

| Crescent City, CA | -2.8% | Far north coast, smaller economy. |

| Santa Cruz, CA | -2.7% | Beautiful, but very expensive. A slight correction isn't shocking. |

| Stockton, CA | -2.6% | Central Valley, affordability draw. |

| Redding, CA | -2.3% | Northern CA, another area that saw inflow. |

| Yuba City, CA | -2.2% | Near Sacramento, likely influenced by similar trends. |

| Salinas, CA | -1.6% | Agricultural hub, “Salad Bowl of the World.” |

| Oxnard, CA | -1.4% | Coastal, but generally more affordable than LA or Santa Barbara. |

| Modesto, CA | -1.3% | Central Valley, another affordability-driven market. |

| San Luis Obispo, CA | -1.3% | “Happiest City in America,” but happiness comes at a price. |

| Los Angeles, CA | -1.2% | Massive, diverse market. A slight dip here is still significant in dollar terms for many neighborhoods. |

| Merced, CA | -1.0% | Central Valley, near UC Merced. |

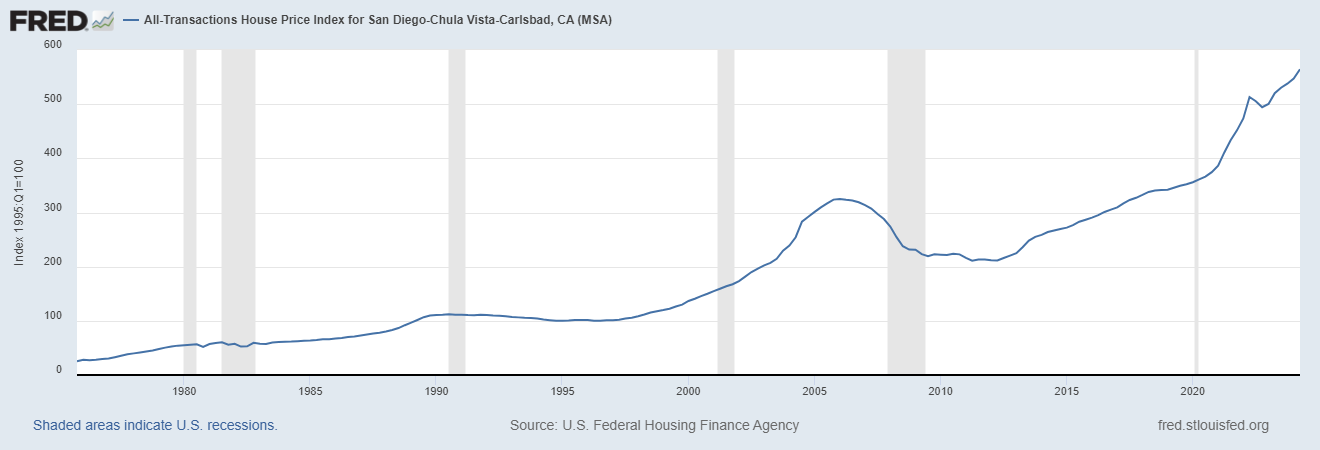

| San Diego, CA | -0.7% | Always desirable. A smaller dip suggests underlying strength, but not immune. |

| Fresno, CA | -0.6% | Major Central Valley city, affordability is key. |

| Hanford, CA | -0.4% | Smaller Central Valley community. |

| El Centro, CA | -0.2% | Imperial Valley, unique border economy. |

| Riverside, CA | -0.1% | Inland Empire, a major recipient of coastal out-migration. Almost flat, showing some stability. |

| Madera, CA | -0.1% | Central Valley, very slight dip. |

Data Source: Zillow, forecast as of April 30, 2025, for declines by April 30, 2026.

Looking at this list, a few things jump out at me.

- Northern California Dominance: Many of the areas with the steepest projected declines, like Ukiah, Eureka, and San Francisco, are in the northern part of the state. San Francisco and San Jose, despite being major economic engines, are on this list. This tells me that even in robust job markets, the sheer cost of housing has hit a ceiling for many. The work-from-home shift might also still be playing out, with some people realizing they don't need to be in the most expensive epicenters.

- Varying Degrees of Impact: Notice the range. Ukiah is looking at a potential 7.6% drop, while Riverside and Madera are almost flat. This highlights that real estate is incredibly local. What happens in one part of California can be very different from another.

- Major Metros Aren't Immune: Seeing Los Angeles (-1.2%) and San Diego (-0.7%) on the list, even with smaller declines, is noteworthy. These are huge, desirable markets. It suggests a broader cooling trend. For me, this isn't panic time; it's more of a “market taking a breath” moment.

- Affordability Havens Adjusting: Places like Sacramento (-3.0%) and many Central Valley cities saw significant price jumps as people fled coastal prices. It's natural for these markets to see some recalibration as that frenzy subsides.

What's Causing This Shift in California?

From my perspective, several ingredients are mixing together to create this potential cooldown:

- Affordability, Affordability, Affordability: I can't say this enough. California home prices, coupled with mortgage rates that are much higher than a few years ago, have simply pushed many buyers to their limits, or out of the market altogether. When fewer people can afford to buy, demand softens, and prices can follow.

- Increased Inventory: As Zillow noted nationally, more homes are coming on the market. In California, I'm seeing sellers who might have held off finally deciding to list, perhaps realizing the peak frenzy is over. This gives buyers more choice and less pressure to bid up prices.

- Economic Winds: While the California economy has many strengths, particularly in tech and entertainment, any whiff of broader economic slowdown or uncertainty in specific sectors (like tech layoffs we saw) can make people cautious about making huge financial commitments like buying a home.

- The “Normalization” Factor: The past few years were, frankly, a bit wild in real estate. The super-low interest rates and pandemic-driven housing shuffle created an unusually hot market. What we might be seeing now is a return to more typical market behavior. A 3-7% decline in some of these markets after years of double-digit gains isn't a catastrophe; it's a correction.

So, What Does This Mean for You?

This is where the rubber meets the road. How does this forecast affect your plans?

If You're a Potential Buyer:

- Opportunity Knocks (Softly): This could be good news! A price decline, even a modest one, combined with more homes to choose from, can ease some of the pressure. You might have more room to negotiate.

- Don't Expect Fire Sales: A 5% dip in San Francisco is still a very expensive house. This isn't 2008 all over again. Lending standards are tighter, and we don't have the same level of distressed properties.

- Mortgage Rates Still Matter: A price drop can be easily offset by high interest rates. Keep a close eye on rates and factor them heavily into your budget. My advice? Get pre-approved so you know exactly what you can afford.

- Focus on the Long Haul: Trying to perfectly “time the market” is a bit of a fool's errand. If you find a home you love, in a neighborhood you like, and it fits your long-term financial plan, that's often more important than squeezing out an extra percentage point on the price.

If You're a Potential Seller:

- Adjust Expectations: You might not get the peak-2022 price you were dreaming of. Be realistic about current market conditions in your specific neighborhood.

- Price It Right: In a softening market, an overpriced home will just sit. Work with a good local agent to price your home competitively from the start. Chasing the market down with price reductions is no fun.

- Presentation Matters More Than Ever: With more competition, your home needs to shine. Invest in staging, good photos, and address any needed repairs.

- Patience May Be Needed: Homes might take a bit longer to sell than they did a year or two ago.

What About Rents?

Here's an interesting wrinkle from Zillow's forecast: while home values might dip, they expect rents to keep climbing. They project single-family rents to rise by 3.2% in 2025, and multifamily (apartment) rents to go up by 2.1%.

This makes sense to me. If buying remains challenging due to affordability, more people will stay in the rental market, particularly for single-family homes which offer more space. This sustained demand, even with some increase in rental listings, will likely keep upward pressure on rents. It's a reminder that the housing market has many interconnected parts.

My Personal Take: This is a Recalibration, Not a Rout

Having weathered a few California real estate cycles, I see this forecast not as a cause for alarm, but as a sign of the market seeking a new equilibrium. California's fundamental appeal – its economy, climate, and lifestyle – remains strong. There's also a chronic undersupply of housing that isn't going away overnight.

These projected declines, for the most part, are relatively modest when you consider the huge run-up in prices over the last decade. For many markets, it's a shaving off of some of the recent, more frenzied gains.

A Few Caveats to Keep in Mind:

- Forecasts are Educated Guesses: Zillow has great data, but the future is never certain. Economic conditions, interest rate policies, or even unforeseen events can change the trajectory.

- Hyper-Local is Key: Remember that “San Francisco MSA” or “Los Angeles MSA” covers a vast area. Conditions can vary significantly from one neighborhood to the next, even one street to the next.

- This Isn't 2008: It's important to repeat this. The underlying conditions are different. We don't have the same risky lending practices or the sheer volume of foreclosures that fueled the last major downturn.

So, if you're in California, or looking to be, the news that 31 California housing markets are expected to see price decline by April 2026 is definitely something to pay attention to. It signals a shift towards a market that might offer a little more balance, a bit more breathing room for buyers, and a call for realistic expectations from sellers.

“Invest in Real Estate in the Best U.S. Markets”

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Related Articles:

- Is the California Housing Market Heading for a Crash or Correction?

- California Housing Market Predictions 2025

- California Housing Market Rebounds With Highest Sales in 2 Years

- The Great Recession and California's Housing Market Crash: A Retrospective

- California Housing Market Cools Down: Is it a Buyer's Market Yet?

- California Dominates Housing With 7 of Top 10 Priciest Markets

- Real Estate Forecast Next 5 Years California: Boom or Crash?

- Anaheim, California Joins Trillion-Dollar Club of Housing Markets

- California Housing Market: Nearly $174,000 Needed to Buy a Home

- Most Expensive Housing Markets in California

- Abandoned Houses for Free California: Can You Own Them?

- California Housing in High Demand: 19 Golden State Cities Sizzle

- Homes Under 50k in California: Where to Find Them?

- Will the California Housing Market Crash?

- California Housing Market Crash: Is a Correction Coming Up?