Del City, Oklahoma, is a vibrant community with a thriving housing market. In recent years, the city has experienced a surge in home values and a competitive buying environment. Currently, the Del City housing market can be characterized as a balanced market, offering opportunities for both buyers and sellers.

While buyers may benefit from a slightly increased inventory and a more favorable negotiation environment, sellers can still capitalize on the demand for homes and favorable pricing trends. We will discuss the details of the Del City housing market trends and the recent forecasts for 2024.

Del City, OK Housing Market Trends in 2024

How is the Housing Market Doing Currently?

In February 2024, the housing market in Del City, Oklahoma, continued to show resilience and growth, with home prices experiencing a 4.8% increase compared to the previous year. According to Redfin, the median price for homes in Del City reached $153K, reflecting a steady appreciation in property values.

However, despite the uptick in prices, the pace of home sales has slightly slowed down, with properties spending an average of 33 days on the market, a notable increase from 7 days the previous year. Additionally, the number of homes sold in February 2024 decreased slightly to 20, down from 22 during the same period last year.

How Competitive is the Del City Housing Market?

The housing market in Del City presents a somewhat competitive landscape for both buyers and sellers. Properties tend to sell relatively quickly, with an average time on market of 37 days. Some homes even receive multiple offers, indicating a level of competition among potential buyers. On average, homes in Del City sell for approximately 3% below the list price, with hot homes often selling at or near the list price and going pending in as little as 13 days.

Are There Enough Homes for Sale to Meet Buyer Demand?

While Del City offers a diverse range of properties for sale, there have been notable shifts in the market dynamics. The sale-to-list price ratio has remained relatively stable at 98.6%, reflecting a slight increase of 0.9 percentage points year-over-year. However, the percentage of homes sold above the list price has decreased to 30.0%, down 10.9 percentage points from the previous year. Additionally, there has been an increase in the number of homes with price drops, rising to 56.3% year-over-year.

What is the Future Market Outlook for Del City?

Despite the current nuances in the Del City housing market, the future outlook remains optimistic. With steady appreciation in home values and a consistent level of buyer interest, Del City continues to attract homebuyers seeking affordability and quality of life within the metropolitan area. Although there may be fluctuations in market conditions, the overall trajectory suggests continued growth and stability in the real estate sector.

Understanding migration and relocation trends provides valuable insights into the evolving dynamics of the Del City housing market. From December '23 to February '24, 17% of Del City homebuyers explored the option of moving out of the area, while 83% expressed a preference for staying within the metropolitan area. Interestingly, only 0.30% of homebuyers nationwide searched to move into Del City from outside metros. Among these, buyers from Los Angeles showed the highest interest in relocating to Del City, followed by those from Dallas and Seattle.

Del City Housing Neighborhoods:

Del City offers a variety of neighborhoods to choose from, each with its own unique character and charm. Some of the most popular neighborhoods as found on Realtor.com include:

- East Del City: This established neighborhood is known for its mature trees, quiet streets, and family-friendly atmosphere. Homes in East Del City tend to be older and more traditional, with prices ranging from the mid-$100,000s to the upper-$200,000s.

- West Del City: This up-and-coming neighborhood is home to a mix of new and older homes, as well as a growing number of businesses and restaurants. Homes in West Del City tend to be more affordable than those in East Del City, with prices starting in the low-$100,000s.

- North Del City: This rapidly developing neighborhood is home to several new subdivisions and a number of popular amenities, such as the Del City Public Library and the Del City Community Center. Homes in North Del City tend to be newer and more modern, with prices ranging from the mid-$100,000s to the upper-$300,000s.

- South Del City: This historic neighborhood is home to a number of older homes, as well as a few newer subdivisions. South Del City is also home to the Tinker Air Force Base, which provides a major source of employment for the area. Homes in South Del City tend to be more affordable than those in other parts of Del City, with prices starting in the low-$100,000s.

Del City Housing Market Forecast 2024

Summarizing the Del City housing market forecast, the data points towards a resilient and growing market. The rise in home values, coupled with a relatively short time on the market, suggests a favorable environment.

1. Average Del City Home Value:

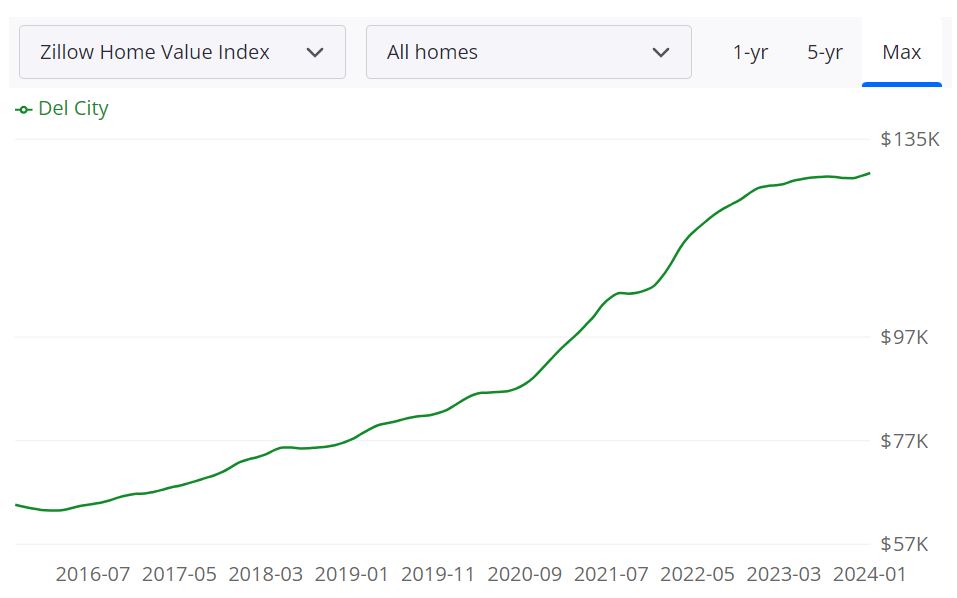

According to Zillow, the average home value in Del City stands at $128,779, reflecting a 2.0% increase over the past year. This metric serves as a key indicator of the market's overall health, showcasing positive growth.

2. Days on Market:

Homes in Del City have a median days on market of approximately 27 days, signifying a swift process from listing to pending. This suggests a competitive market and a favorable environment for sellers.

3. Inventory Metrics (January 31, 2024):

- For Sale Inventory: The current inventory includes 67 homes, providing prospective buyers with a range of options.

- New Listings: In January 2024, there were 24 new listings, contributing to the city's housing stock.

4. Median Sale and List Prices:

- Median Sale Price (December 31, 2023): The median sale price for Del City homes at the end of 2023 was $127,800.

- Median List Price (January 31, 2024): As of January 2024, the median list price is $154,632, indicating a potential upward trend in property values.

Are Home Prices Dropping in Del City?

Contrary to a drop in home prices, the data reveals a 2.0% increase in the average home value over the past year. This upward trend signifies a growing market and emphasizes the stability of property values in Del City. Based on the current indicators, there is no immediate risk of a housing market crash in Del City. The steady rise in home values and the overall market dynamics suggest a resilient and sustainable real estate environment. However, it's essential to monitor future trends for a comprehensive understanding.

Is Now a Good Time to Buy a House in Del City?

For potential homebuyers, the current conditions present both opportunities and challenges. The Seller's Market indicates competition, but with mortgage rates playing a crucial role, it's advisable for buyers to assess their financial readiness. Considering the overall growth and stability, now can still be a good time to buy, especially for those prepared to navigate a competitive market.

Investing in the Del City Real Estate Market: A Comprehensive Analysis

1. Population Growth and Trends:

The population growth in Del City is a key factor for real estate investors to consider. Del City has experienced consistent population growth trends, contributing to the demand for housing. A growing population often indicates a need for residential properties, making it a favorable environment for real estate investments.

2. Economy and Jobs:

- Strong Local Economy: Del City boasts a robust local economy with factors such as job diversity and economic stability. A thriving economy enhances the overall real estate market, attracting potential homebuyers and renters.

- Job Opportunities: The presence of job opportunities, including the proximity to the Tinker Air Force Base, provides a steady source of employment. A stable job market is a positive indicator for real estate investors as it influences demand for rental properties and homeownership.

3. Livability and Other Factors:

- Quality of Life: Del City's livability factors, such as amenities, schools, and community services, contribute to its appeal. A city with a high quality of life tends to attract individuals and families, boosting the demand for housing.

- Infrastructure and Development: Ongoing infrastructure projects and urban development can enhance the overall attractiveness of the real estate market. Investors should assess the city's commitment to infrastructure improvements for long-term investment potential.

4. Rental Property Market Size and Growth:

The size and growth of the rental property market in Del City present lucrative opportunities for investors:

- Market Size: Analyzing the current size of the rental market provides insights into the potential tenant pool. Del City's growing population and economic stability contribute to a sizable rental market.

- Growth Trends: Assessing the growth trends in rental demand helps investors anticipate future opportunities. Factors such as job growth and population influx can influence the demand for rental properties.

5. Other Factors Related to Real Estate Investing:

- Market Appreciation: Historical and potential future appreciation in property values can be a compelling reason for investment. Del City's steady increase in home values is a positive indicator.

- Regulatory Environment: Understanding the local regulatory environment for real estate investments is crucial. Stay informed about zoning laws, property taxes, and any upcoming regulatory changes that may impact your investment strategy.

- Community Development Plans: Investigate any community development plans that may affect the real estate market. City initiatives and planned developments can influence property values and rental demand.

In summary, investing in the Del City real estate market offers a range of opportunities. From a growing population and a strong job market to a thriving rental property sector, the city presents a favorable environment for investors seeking long-term growth and stability.

Before making any investment decisions, it is advisable for potential investors to conduct thorough research, seek professional advice, and stay informed about both local and broader market trends.

References:

- https://www.redfin.com/city/5132/OK/Del-City/housing-market

- https://www.realtor.com/realestateandhomes-search/Del-City_OK/overview

- https://www.zillow.com/home-values/21558/del-city-ok/