If you're looking for a quick answer, here it is: The Interest Rate Forecast for the Next 10 Years suggests a gradual decline in interest rates initially, followed by a period of stabilization and then a slow climb back up. Experts believe the Federal Reserve will begin cutting rates in 2025, aiming for a long-term target of around 2% by 2027, but rates may rise again in the early 2030s. That said, let's dig into the details, because the economic road ahead is rarely a straight line.

Interest Rate Forecast for Next 10 Years: Are Lower Rates on the Horizon?

Ever wondered how much those little numbers – interest rates – can impact your life? From the mortgage on your home to the savings account you're diligently contributing to, interest rates are the silent influencers of our financial well-being. The Federal Reserve (the Fed), the central bank of the United States, has a significant role to play in deciding the direction of the interest rates, and it's therefore crucial to stay updated with the changes. So, let's buckle up and explore the projected path of interest rates over the next decade and what it all means for you.

Where Are Interest Rates Right Now? A Quick Snapshot

As of February 2025, the Fed's target federal funds rate sits between 4.25% and 4.5%. This is a key rate because it influences what banks charge each other for overnight lending, and that, in turn, affects a whole host of other interest rates that we see every day.

Now, there's a general expectation that the Fed will start lowering rates sometime in 2025. The reason? Inflation seems to be cooling down, and economic growth isn't quite as hot as it used to be. Think of it like this: the Fed is trying to find the sweet spot where the economy is growing at a healthy pace, but prices aren't rising too quickly.

A Year-by-Year Look: Projecting Interest Rates from 2025 to 2035

Okay, time for the meat and potatoes! I've put together a table showing the projected interest rates for the next decade, along with the likelihood of the Fed cutting rates in each of those years:

| Year | Projected Federal Funds Rate | Probability of Rate Cut (%) |

|---|---|---|

| 2025 | 3.75% – 4.00% | 70 |

| 2026 | 3.00% – 3.25% | 80 |

| 2027 | 2.00% – 2.25% | 90 |

| 2028 | 2.00% – 2.25% | 85 |

| 2029 | 2.25% – 2.50% | 60 |

| 2030 | 2.50% – 2.75% | 55 |

| 2031 | 2.75% – 3.00% | 50 |

| 2032 | 3.00% – 3.25% | 45 |

| 2033 | 3.25% – 3.50% | 40 |

| 2034 | 3.50% – 4.00% | 30 |

| 2035 | 4.00% – 4.25% | 20 |

Let's break down what this table is telling us:

- 2025: We're likely to see the start of rate cuts, bringing the federal funds rate down a bit. This is the Fed reacting to inflation cooling off.

- 2026: The cuts continue, potentially bringing the rate down further. The Fed is probably trying to encourage more economic activity.

- 2027: The Fed might be close to its long-term target for interest rates. This is the level where they believe the economy can grow steadily without inflation getting out of hand.

- 2028-2029: A period of stability might be on the horizon. The Fed could take a “wait and see” approach to assess the impact of the earlier rate cuts. It is also possible that a slight upward movement may begin as growth pressures emerge.

- 2030-2031: The forecasts indicate a gradual upward adjustment. As the economic expansion gains traction, the federal funds rate could edge higher.

- 2032-2033: To combat potential inflation or overheating of the economy, the Fed may increase interest rates again.

- 2034-2035: As the economy matures, projections suggest rates could stabilize closer to historical norms. The probability of cuts is reduced.

Keep in mind: These are just projections! The future is never set in stone. There are many factors that could change these numbers.

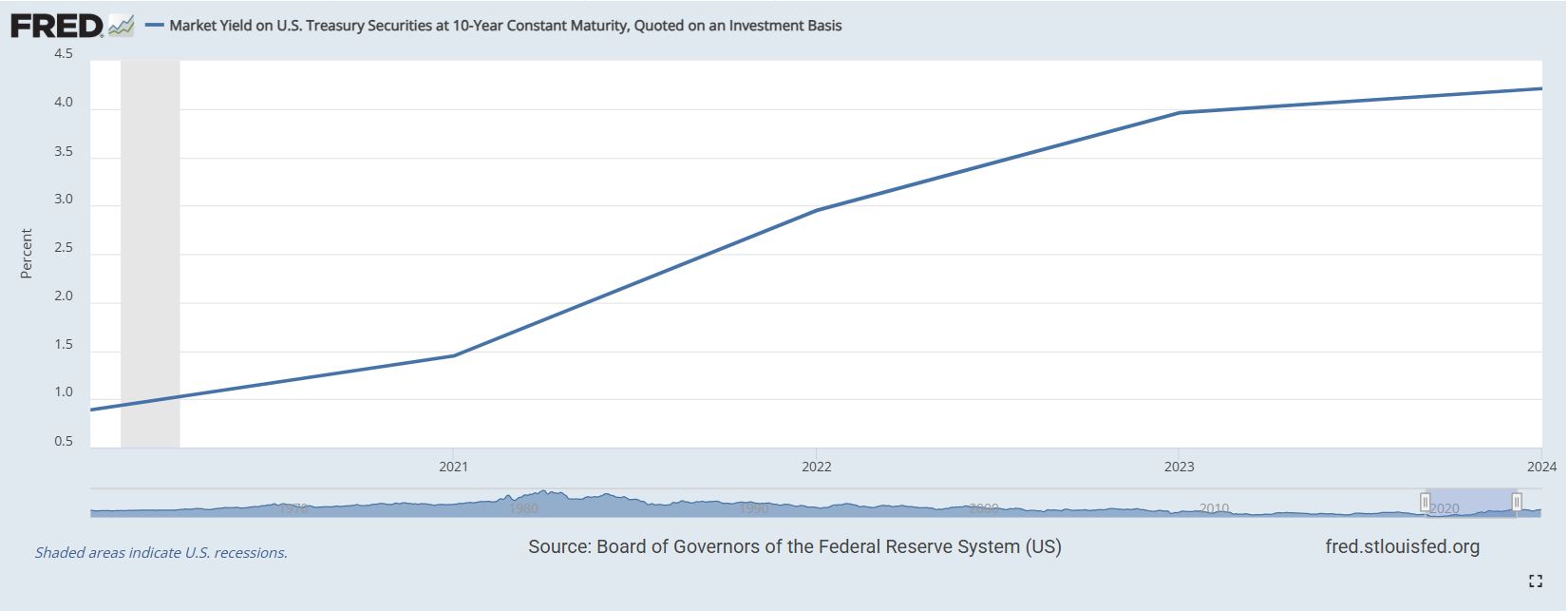

A Decade of Change: How Fed Interest Rates Evolved (2014-2024)

The decade from 2014 to 2023 witnessed a dynamic shift in Federal Reserve (Fed) interest rate policy, moving away from the unprecedented low rates implemented in the wake of the 2008 financial crisis. Here's a detailed overview:

- 2014-2015: Tapering and Initial Hike: This period signified the end of the zero-interest-rate policy (ZIRP) era. After years of maintaining near-zero rates to support the economic recovery, the Fed began signaling its intention to normalize monetary policy. In December 2015, the Fed cautiously initiated its rate-hiking cycle, raising the target federal funds rate from a range of 0% to 0.25% to a range of 0.25% to 0.50%. This move reflected growing confidence in the strength of the labor market and the overall economy.

- 2016-2018: Gradual Normalization: The Fed continued its gradual approach to raising interest rates throughout this period, implementing measured increases at several Federal Open Market Committee (FOMC) meetings. By December 2018, the target range had reached 2.25% to 2.50%. These increases were driven by sustained economic growth, a declining unemployment rate, and the Fed's efforts to manage inflation and prevent the economy from overheating.

- 2019: A Pivot to Accommodation: As economic growth slowed and global uncertainties increased, the Fed adopted a more dovish stance in 2019. After multiple rate hikes in prior years, the central bank paused its tightening cycle and subsequently lowered interest rates three times during the year. By year-end, the target range had been reduced to 1.50% to 1.75%. The Fed cited concerns about global economic developments, trade tensions, and muted inflation as reasons for its policy shift.

- 2020-2023: Crisis Response and Extended Accommodation: The onset of the COVID-19 pandemic in early 2020 triggered a sharp economic contraction. In response, the Fed aggressively slashed interest rates back to near zero (0% to 0.25%) to cushion the economic blow, support financial markets, and encourage borrowing and investment. This ultra-low rate environment persisted for several years as the Fed focused on fostering a strong and inclusive recovery. In 2022 and 2023, the Fed aggressively raised rates to combat rising inflation.

The Crystal Ball: What Influences Interest Rate Decisions?

So, what makes the Fed tick? What factors do they consider when deciding whether to raise, lower, or hold steady on interest rates? Here are a few of the big ones:

- Inflation: This is the big kahuna. If prices are rising too quickly, the Fed will often raise interest rates to slow things down. They want to keep inflation around 2%.

- Economic Growth: The Fed also wants the economy to grow at a healthy pace. If growth is too slow, they might lower rates to encourage borrowing and spending.

- Labor Market Conditions: A strong job market with lots of hiring and rising wages can put upward pressure on inflation. The Fed will keep a close eye on unemployment rates, job growth, and wage trends.

- Global Economic Factors: The world is interconnected. What happens in other countries can affect the U.S. economy. Geopolitical instability, trade wars, or economic slowdowns in major economies can all influence the Fed's decisions.

- Financial Stability: The Fed also wants to make sure the financial system is stable. Big market crashes or banking crises can prompt them to lower rates to provide support.

My Two Cents: Some Personal Thoughts on the Road Ahead

Now, I'm not an economist with a fancy degree. But I've been following the economy for a while, and here are a few of my personal thoughts on what might happen:

- Inflation Will Be Key: I think whether the Fed can successfully bring inflation down to its 2% target will be the biggest driver of interest rate decisions over the next few years. If inflation proves stubborn, we could see interest rates stay higher for longer than expected.

- The Global Economy is a Wildcard: There's a lot of uncertainty in the world right now, from geopolitical tensions to potential trade disruptions. These factors could easily throw a wrench into the Fed's plans.

- Don't Expect a Quick Return to “Normal”: After a period of historically low interest rates, I think it's unlikely that we'll see rates return to those levels anytime soon. The economy has changed, and the Fed's approach may need to change with it.

What Does This Mean for You?

Okay, enough with the economic jargon! Let's talk about how these potential interest rate changes could affect your life:

- Mortgages: Lower interest rates mean lower mortgage payments. If you're thinking about buying a home or refinancing your existing mortgage, keep an eye on interest rate trends.

- Savings Accounts: Higher interest rates on savings accounts are good news for savers. You'll earn more money on your deposits.

- Loans: Interest rates on car loans, personal loans, and credit cards are also affected by the Fed's decisions. Lower rates can make it cheaper to borrow money.

- Investments: Interest rates can also influence the stock market and other investments. Lower rates can sometimes boost stock prices, while higher rates can have the opposite effect.

Staying Informed: Resources for Further Reading

If you want to dig deeper into this topic, here are a few resources I recommend:

These websites provide a wealth of information on the economy and the Fed's policies.

The Bottom Line

The Interest Rate Forecast for the Next 10 Years points towards a period of gradual adjustments as the Fed tries to navigate the complex economic landscape. It's not a simple situation, but understanding the key factors and following the trends can help you make smarter financial decisions.

Remember, I'm just a regular person sharing my thoughts. This is not financial advice. Always do your own research and consult with a qualified financial advisor before making any major decisions.

Navigate a Decade of Shifting Interest Rates with Norada

As the Interest Rate Forecast for the Next 10 Years signals market changes, turnkey real estate investments provide a stable income source.

Capitalize on high-quality, ready-to-rent properties designed to deliver consistent returns even amid economic fluctuations.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Recommended Read:

- Fed Cuts Interest Rates by 25 Basis Points: What It Means for You

- Interest Rates Predictions for 5 Years: Where Are Rates Headed?

- Projected Interest Rates in 5 Years: A Look at the Forecasts

- Fed's Powell Hints of Slow Interest Rate Cuts Amid Stubborn Inflation

- Fed Funds Rate Forecast 2025-2026: What to Expect?

- Interest Rate Predictions for 2025 and 2026 by NAR Chief

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Interest Rate Predictions for the Next 3 Years: (2024-2026)

- Interest Rate Predictions for Next 2 Years: Expert Forecast

- Impact of Interest Rate Cut on Mortgages, Car Loans, and Your Wallet